Featured M&A Advisor: Q&A with Rudy Moeller

Rudy Moeller is an M&A Advisor and business broker operating in Louisville, KY. He holds a BA and an MBA from Vanderbilt University, and he’s a bourbon connoisseur who loves to host tastings. Our Managing Partner, Max Friar, asks him a few questions about how he came to the decision to become a business broker. […]

Midwest Die, Corp. of Baroda, MI Acquired by Lateral Industries, LLC!

Calder Capital, LLC is proud to announce the sale of Midwest Die, Corp. of Baroda, MI to Lateral Industries, LLC. Lateral Industries, LLC, is owned by CEO Scott Dawson and his business partners. The business will continue to operate as Midwest Die, Corp. After almost 40 years in the business, cousins and partners Rodney and […]

Midwest Die, Corp. of Baroda, MI Acquired by Lateral Industries, LLC!

Calder Capital, LLC is proud to announce the sale of Midwest Die, Corp. of Baroda, MI to Lateral Industries, LLC. Lateral Industries, LLC, is owned by CEO Scott Dawson and his business partners. The business will continue to operate as Midwest Die, Corp. After almost 40 years in the business, cousins and partners Rodney and […]

Market Remarks Q3 2021: Max Friar Interviews Transaction Attorney Andrew Longcore

In lieu of our usual collaborative Q3 report, our Managing Partner Max Friar sat down with colleague and longtime friend Andrew Longcore for a Q&A on what he’s been seeing in the Q3 business market. Andrew has unique experience as both a transaction attorney and M&A advisor facilitating deals. Max: How are owners/sellers feeling right […]

Industrial Fabrication Company Acquired by SE MI Welding & Fabrication Company

Calder Capital is pleased to announce a strategic investment in its client, an Industrial Fabrication Company in Tri-Cities, MI by a SE Michigan Welding & Fabrication Company. The acquisition is a strategic one for the SE Michigan Company. One of the partners of the acquired Fabrication Company will stay on and continue operating as the […]

Industrial Fabrication Company Acquired by SE MI Welding & Fabrication Company

Calder Capital is pleased to announce a strategic investment in its client, an Industrial Fabrication Company in Tri-Cities, MI by a SE Michigan Welding & Fabrication Company. The acquisition is a strategic one for the SE Michigan Company. One of the partners of the acquired Fabrication Company will stay on and continue operating as the […]

Worldwide Diesel of Niles, MI Acquired by Individual Investor

Calder Capital is thrilled to announce that Worldwide Diesel of Niles, Michigan has been acquired by an individual investor. Worldwide Diesel was acquired by Rich Campbell, a Michigan native who has spent the past several years of his career in San Francisco, California. Campbell brings a vast array of experience including business development, data analytics, […]

Worldwide Diesel of Niles, MI Acquired by Individual Investor

Calder Capital is thrilled to announce that Worldwide Diesel of Niles, Michigan has been acquired by an individual investor. Worldwide Diesel was acquired by Rich Campbell, a Michigan native who has spent the past several years of his career in San Francisco, California. Campbell brings a vast array of experience including business development, data analytics, […]

Calder Capital/SBDA Close 30th Transaction of 2021, March Towards Records

Demonstrating their adeptness at maneuvering during the pandemic, Calder/SBDA prove that they are among the fastest-growing M&A firms in the US.

Weinkauf Plumbing & Heating of Alpena, MI Acquired by Investor Group

Calder Capital is pleased to announce that its client, Weinkauf Plumbing & Heating, Inc., has been acquired. Established in 1959 by Walter and Theresa Weinkauf, Weinkauf Plumbing & Heating is a second-generation family plumbing and HVAC contractor located in Alpena, Michigan. Prior to the sale, the business was owned and operated by siblings Rob Weinkauf, […]

Weinkauf Plumbing & Heating of Alpena, MI Acquired by Investor Group

Calder Capital is pleased to announce that its client, Weinkauf Plumbing & Heating, Inc., has been acquired. Established in 1959 by Walter and Theresa Weinkauf, Weinkauf Plumbing & Heating is a second-generation family plumbing and HVAC contractor located in Alpena, Michigan. Prior to the sale, the business was owned and operated by siblings Rob Weinkauf, […]

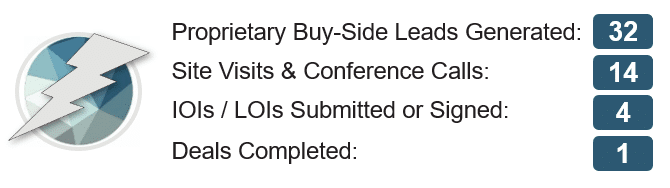

Calder Capital Buy-Side Client Update: September 2021

The leaves are beginning to change and the air is feeling crisp. At Calder, we are stocking the fridge with hard apple cider and as much pumpkin spice coffee as possible. Our Buy-Side team is hard at work fulfilling our current buy-side clients’ mandates. September set a new record for lead generation! How […]

Calder Capital Buy-Side Client Update: August 2021

Can you believe August has already come and gone? It’s time to brief you in detail how Calder Capital’s Buy-Side team is fulfilling our current buy-side clients’ mandates. August was exceptional! How do we do this? It’s not rocket science. We combine a personal touch, automation, and data analytics with the tedious work […]

How to be Prepared Beyond the Pandemic: 4 Tips for the Owner of a Founder-Led Business

“What is my exit strategy?” This likely isn’t the first question a business owner asks when opening a business–let alone the second, third, or fourth question! Focus is better spent elsewhere when getting a business off the ground. At some point, however, the question of exit strategy should re-enter. A Mass Mutual Life Insurance survey […]

C&K Box and Mulch Wholesalers of Jackson, MI Acquired by an Individual Investor!

Calder Capital is pleased to announce that C&K Box and Mulch Wholesalers of Jackson, MI have been acquired by an individual investor. Founded in 1960, C&K Box manufactures wood packaging products such as pallets, skids, crates, boxes, corner posts, stakes, and custom products tailored to clients’ needs. C&K Box has been owned by the Stevens […]

C&K Box and Mulch Wholesalers of Jackson, MI Acquired by an Individual Investor!

Calder Capital is pleased to announce that C&K Box and Mulch Wholesalers of Jackson, MI have been acquired by an individual investor. Founded in 1960, C&K Box manufactures wood packaging products such as pallets, skids, crates, boxes, corner posts, stakes, and custom products tailored to clients’ needs. C&K Box has been owned by the Stevens […]

Charlesbrook Protection Services, LLC, of Grand Rapids, MI Acquired by an Individual Investor!

Calder Capital, LLC is excited to announce that Charlesbrook Protection Services, LLC, of Grand Rapids, MI has been acquired by an individual investor. Former police officer Ryan Woodford founded Charlesbrook Protection Services in 2014. Charlesbrook provides security guards for hire to protect businesses, institutions, and events. Charlesbrook was acquired by 10-year Marine veteran Chris Jansens, […]

Charlesbrook Protection Services, LLC, of Grand Rapids, MI Acquired by an Individual Investor!

Calder Capital, LLC is excited to announce that Charlesbrook Protection Services, LLC, of Grand Rapids, MI has been acquired by an individual investor. Former police officer Ryan Woodford founded Charlesbrook Protection Services in 2014. Charlesbrook provides security guards for hire to protect businesses, institutions, and events. Charlesbrook was acquired by 10-year Marine veteran Chris Jansens, […]

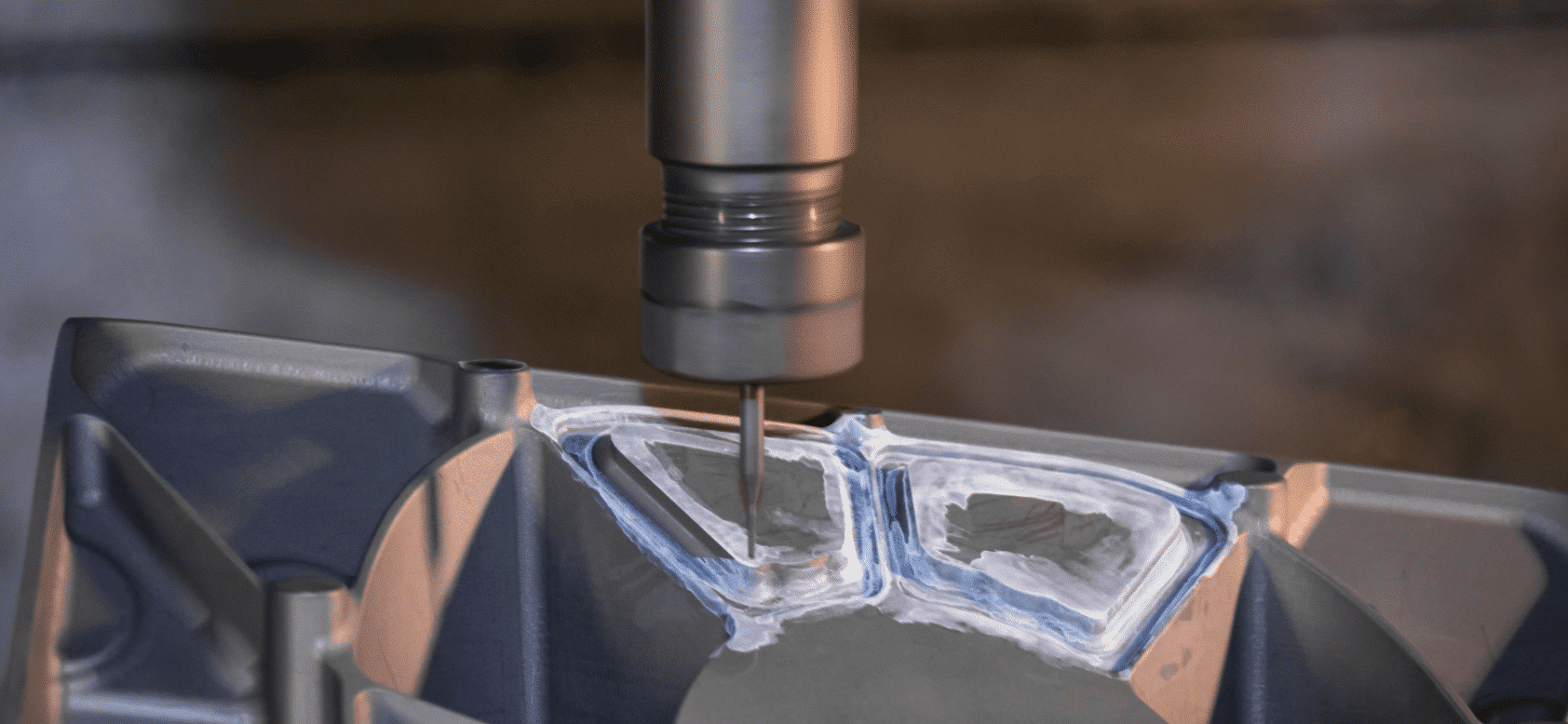

Eidemiller Precision Machining of Milford, MI Acquired by Kyowa Industrial Co., Ltd. of Takasaki Japan!

Calder Capital, LLC, is excited to announce the acquisition of Eidemiller Precision Machining of Milford, Michigan by Kyowa Industrial, Co., Ltd., of Takasaki, Japan. Established in 1946, Kyowa Industrial is a precision manufacturer of complex prototype components and low volume production runs. The company is known for its exceptionally high-quality production of complex prototypes, dramatically […]

Eidemiller Precision Machining of Milford, MI Acquired by Kyowa Industrial Co., Ltd. of Takasaki Japan!

Calder Capital, LLC, is excited to announce the acquisition of Eidemiller Precision Machining of Milford, Michigan by Kyowa Industrial, Co., Ltd., of Takasaki, Japan. Established in 1946, Kyowa Industrial is a precision manufacturer of complex prototype components and low volume production runs. The company is known for its exceptionally high-quality production of complex prototypes, dramatically […]

Record Growth Lands Calder Capital on Inc’s 5000 Fastest-Growing Companies List

Calder’s trail-blazing ascent to the fastest-growing M&A firm in the US–even through 2020. Grand Rapids, MI – August 10, 2021 – Michigan-headquartered M&A firm Calder Capital today announced it had been named to Inc. Magazine’s top 5000 most successful private companies in the country. Every year, Inc. generates a list of the top 5000 most […]

Calder Capital Welcomes Niko Singh to the Advisor Team!

Calder Capital is thrilled to welcome Niko Singh to the firm as our new Mergers and Acquisitions Advisor. Based in Pittsburgh, PA, Mr. Singh will be providing sell-side and buy-side advisory services to businesses located in the East Coast area. Niko has a wide range of business experience which makes him an asset to any […]

Calder Capital Buy-Side Client Update: July 2021

Calder Capital is thrilled to be able to give you an update on how we’re fulfilling our current buy-side clients’ mandates. July was a busy month! How do we do this? It’s not rocket science. We combine a personal touch, automaton, and data analytics with the tedious work that no one wants to […]

Calder Capital Market Remarks Q2 2021

Trending: #TheGreatQuitof2021 #laborshortage #supplychain #burnout All things considered, the first quarter of 2021 started out pretty well for small M&A deals, and Q2 continued to show seller appetites returning, albeit still at multi-year lows. What’s apparent, however, is a lot of shifting in the landscape of the market in terms of demand, motivations for selling, […]

Paramount Fence of Livonia, MI Acquired by Local Investors from the Building Products Industry

Calder Capital is thrilled to announce the acquisition of Paramount Fence in Livonia, MI by metro-Detroit based investors in the building products industry! Paramount Fence was established in 2010 by John and Tabetha Burke. Over its ten years in operation, Paramount Fence has been consistently ranked as one of the top fence installation companies in […]

Paramount Fence of Livonia, MI Acquired by Local Investors from the Building Products Industry

Calder Capital is thrilled to announce the acquisition of Paramount Fence in Livonia, MI by metro-Detroit based investors in the building products industry! Paramount Fence was established in 2010 by John and Tabetha Burke. Over its ten years in operation, Paramount Fence has been consistently ranked as one of the top fence installation companies in […]

Calculating the Proposed 2022 Tax Change Impact in M&A

In early June of 2021, the Biden administration proposed a new framework for comprehensive tax changes. These proposed changes would affect both the ordinary income tax rates and the long-term capital gains rate. Here is a review of the proposed changes: Ordinary Income Impact: Taxpayers with an adjusted gross income of more than $1 million […]

Calder Capital Buy-Side Client Update: June 2021

Calder Capital is thrilled to be able to give you an update on how we’re fulfilling our current buy-side clients’ mandates. June was exceptional! How do we do this? It’s not rocket science. We combine data analytics with the tedious work that no one wants to do – lots of research, cold calls, and email […]

Benchmark Industrial Acquires Packaging Supplier Donby Packaging!

Calder Capital is thrilled to announce the acquisition of Donby Packaging of Brooklyn Heights, OH by Benchmark Industrial, Inc. of Gahanna, OH. Benchmark Industrial, Inc. is a single-source supplier of packaging and warehouse essentials. Since 1963, they’ve shaped their business around fast, accurate service and delivery. Benchmark’s acquisition of Donby Packaging, a smaller player within […]

Benchmark Industrial Acquires Packaging Supplier Donby Packaging!

Calder Capital is thrilled to announce the acquisition of Donby Packaging of Brooklyn Heights, OH by Benchmark Industrial, Inc. of Gahanna, OH. Benchmark Industrial, Inc. is a single-source supplier of packaging and warehouse essentials. Since 1963, they’ve shaped their business around fast, accurate service and delivery. Benchmark’s acquisition of Donby Packaging, a smaller player within […]

Internships In M&A, Investment Banking, & Private Equity – Advice & Tips

M&A Advisor and Internship Program Director, Garrett Monroe, shares his insights on how to get the most out of your internship experience. Internships, especially in competitive industries like M&A, Investment Banking, and Private Equity are more than just an experience to put on your resume. “A small percentage of people in the U.S., and even […]

Calder Capital Buy-Side Client Update: May 2021

Calder Capital is thrilled to be able to give you an update of how we’re fulfilling our current buy-side clients’ mandates. This month has been exceptional! Proprietary Buy-Side Leads Generated in May: 24 Site Visits & Conference Calls: 15 IOIs / LOIs Submitted or Signed: 4 How do we do this? It’s not rocket […]

Introducing Roy Ghivoni: World Traveler

Introducing Roy Ghivoni to our Summer 2021 Internship Program! Many of our current advisors came to us as undergraduate interns, green and eager to grow and be challenged! This program is important to the current and future state of our company Our program is not coffee runs and paper pushing. Interns grind hard behind the […]

Calder Capital Buy-Side Client Update: April 2021

Calder Capital is thrilled to be able to give you an update of how we’re fulfilling our current buy-side clients’ mandates. At Calder Capital, we work with a wide variety of buyers, from Private Equity, Strategic and Private Investment Groups, Home Offices, Strategic Companies, to Individual Buyers nationwide. Unlike other firms, we guarantee results. We […]

Calder Capital, LLC Honored as Gold Stevie® Award Winner in 2021 American Business Awards®

GRAND RAPIDS, Mich., April 29, 2021 – Calder Capital, LLC was named the winner of a Gold Stevie® Award in the Company of the Year – Financial Services Category in The 19th Annual American Business Awards® today. The American Business Awards are the USA’s premier business awards program. Nicknamed the Stevies for the Greek word meaning “crowned,” the […]

Financial Search Group of Petoskey, MI Acquired by AXIOS HR of Grand Rapids, MI

Calder Capital, LLC is pleased to announce that Financial Search Group of Petoskey, MI has been acquired by AXIOS HR of Grand Rapids, MI. AXIOS HR is an independent, 100% employee-owned organization, and is the fourth largest privately-held West Michigan employer delivering personalized employment solutions to small and mid-sized companies. Financial Search Group is a […]