With the successful closings of two businesses on 12/28/23, the Calder Capital/SBDA team completed transaction #48 for 2023, surpassing previous annual transaction and revenue records. This is despite global M&A deal volume declining by 7% and 27% year-over-year dollar volume decline rounding off the lowest three-quarter total since 2013. (Source: Skadden) Calder reported 79.1% revenue growth year-over-year and three-year revenue growth of 181%, setting the firm up for an unprecedented 4th consecutive year on Inc 5000 lists.

“2023 has been the most significant year in Calder’s history in terms of growth and investment in the future. Not only did we add 13 team members, increasing our headcount by 50%, but we have grown 102% CAGR for the past 5 years while navigating a labor shortage, pandemic, massive inflation, multiple wars, and significant rate hikes at a pace that none of us have ever experienced,” commented Max Friar, Calder’s Founder and Managing Partner.

Calder’s growth in 2023 was unpinned by a number of strategic moves that will continue to bear significant fruit. In 2023, Calder hired a Director of Continuous Improvement, who is focused squarely on panning the entire business and working with the team to root out inefficiencies and also implement analytics and automation where applicable. Calder brought on M&A Advisors in Grand Rapids, Metro Detroit, and Marquette, MI, Indianapolis, IN, Chicago, IL, and Philadelphia, PA. Additionally, Calder expanded its Central Services and Buy-Side Services departments with multiple Analysts and Associates.

“While we have again experienced explosive growth,” continued Max Friar, “what the market has not witnessed is the unlocked potential that our 13 new team members will bring to the table in 2024 and beyond. It often takes new Analysts, Associates, and Advisors 6+ months to build momentum; many of our team have not even shown a glimpse of their potential production.”

When asked to look into the future, Max had the following thoughts, “I think 2024 is going to be a challenging year, with many similarities to 2023. The political climate will certainly become a stormy cloud hanging over the country, and will leave a faction of prospective buyers and sellers in indecision. Additionally, while the rate environment may improve, we are very far away from the favorable conditions that marked most of 2020-2022. I do believe that we will continue to see pent-up sellers moving to market and they will be met by a buyer pool that is robust and well-funded. Many buyers will continue to want to believe it’s a buyers’ market; I do not believe that will be true. I don’t expect to see anything resembling a buyers’ market until 2025 or after; I believe that there is a likelihood that rates will be lower, the Presidential election will be over, and the environment may seem steady enough to motivate Baby Boomer sellers to move en masse.”

Friar continued, “As it pertains to Calder, we are entering 2024 with a sturdier book of business. At the end of 2022, we had 50 sell-side clients and 18 buy-side clients. We are entering 2024 with 61 sell-side clients and 23 buy-side clients. Despite this, we still have 30-35% capacity for new clients. I am focused squarely on filling up our Advisors so that they can maximize their year. I am hopeful also that the first half of 2024 is not as slow as 2023 was in terms of onboarding new clients. Our team is ready to roll!”

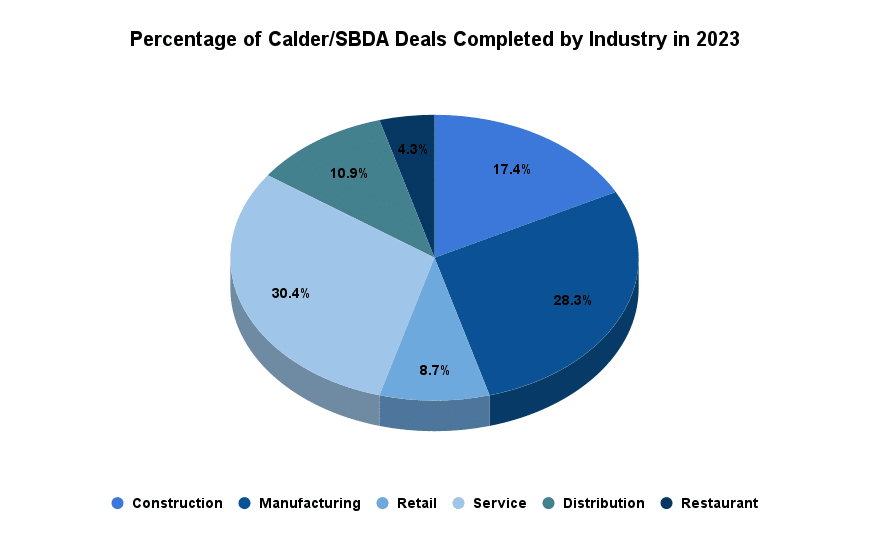

In terms of the types of transactions that are getting done by Calder/SBDA in 2023, service (30.4%) led the way followed by manufacturing (28.3%) transactions, construction (17.4%) deals were in the middle of the pack, distribution transactions (10.9%) were followed closely by retail (8.7%), and sales of restaurants came in at the bottom (4.3%).

More granularly from an industry standpoint, the breakdown of deals has been as follows.

Beyond a diversity of industries, Calder/SBDA continues to expand its geographic reach, closing transactions in 2023 in 9 states.

Per Max Friar, “We are looking forward to growing double digits again in 2024 on the back of our investments in our sales, advisory, and Central Services teams, and we are hopeful that, despite the election chaos, the macroeconomic environment will continue to stabilize, a soft landing ensues, and buyers, sellers, and lenders develop more confidence towards executing transactions. We are planning to continue our geographic expansion and dedication to expanding partner relationships, investing in AI and data analytics, and doubling down on business development.”

Below is a complete list of Calder/SBDA closings through December 31, 2023.

| Seller | Location | Industry |

| Well Drilling Contractor | Michigan | Construction |

| Pro Mold & Die | Roselle, IL | Manufacturing |

| Reinke’s Hearth of the Home Fireplace | Harrison, MI | Retail |

| Cameron Tool (Buy-Side) | Lansing, MI | Manufacturing |

| Sparkle Car Care Centers (Buy-Side) | Benton Harbor, MI | Service |

| Maggie’s Organics | Ann Arbor, MI | Distribution |

| Quality Automotive Repair | Sault Ste Marie, MI | Service |

| Action Water Sports | Hudsonville, MI | Retail |

| Sign Manufacturing Company (Buy-Side) | West Michigan | Manufacturing |

| G & C Glass (Buy-Side) | Lake Zurich, IL | Construction |

| Mechigian Car Washes | Metro Detroit, MI | Service |

| LaFontsee Galleries | Grand Rapids, MI | Service |

| Northern Pipe (Buy-Side) | Green Bay, WI | Service |

| The Ferraro Group | Traverse City, MI | Construction |

| Coach House Iron | Sparta, MI | Manufacturing |

| Maid Brigade | Pittstown, NJ | Service |

| Diamond Die & Mold Co. | Clinton Twp, MI | Manufacturing |

| Welding Manufacturing Company | Lake Zurich, IL | Manufacturing |

| Iverson & Co. | Des Plaines, IL | Distribution |

| Olive Cart | South Haven, MI | Retail |

| Asphalt Maintenance Contractor | Naperville, IL | Construction |

| Forklift Dealership (Buy-Side) | Ohio | Distribution |

| ServPro of Saginaw | Saginaw, MI | Construction |

| Blohm Creative Partners | East Lansing, MI | Service |

| A&W Restaurant of Ortonville | Ortonville, MI | Restaurant |

| Michigan Electric Company | West Michigan | Construction |

| Express Employment Professionals | Kalamazoo, MI | Service |

| Hot Side Service Co. | Grandville, MI | Service |

| Rinzema Greenhouses | Grand Rapids, MI | Retail |

| Waverly Animal Hospital | East Lansing, MI | Service |

| Post Hardwoods | Hamilton, MI | Manufacturing |

| Turner’s Greenscape | Ann Arbor, MI | Service |

| Iverson’s Lumber | Highland Township, MI | Manufacturing |

| Knot Just a Bar | Bay Harbor, MI | Restaurant |

| Koester Metals, Inc. | Fremont, IN | Manufacturing |

| Fortress Manufacturing | Benton Harbor, MI | Manufacturing |

| Environmental Service Company | Northern Michigan | Service |

| Bellingar Packing and Specialty Meats | Ashley, MI | Distribution |

| Double Otis, Inc. | Grand Rapids, MI | Service |

| Distribution Company (Buy-Side) | Midwest | Distribution |

| C&L Cylinder & Machine, LLC (Buy-Side) | Rome, GA | Manufacturing |

| Johnston Contracting, Inc. | Midland, MI | Construction |

| Metal Fabricator | Michigan | Manufacturing |

| Swimming Pool Contractor | Arkansas | Construction |

| Truss Manufacturer | Michigan | Manufacturing |

| Auto Repair Shop | Michigan | Service |

| Pool and Spa Retailer | Indiana | Retail |

| HVAC Contractor | Michigan | Construction |

Please contact Calder if you have an interest in a business valuation, selling a business, or acquiring a business.