Calder Capital is thrilled to announce the successful acquisition of As-Tech Industries of Warren, Michigan by a Midwest-based privately held Metal Fabricator.

Founded in 2000 by Steven Greenland, As-Tech Industries is a metal component fabrication company that has carved a niche in the automotive industry. As a tier-two supplier, the company provides crucial components used in plant-level production. After spending the last 23 years growing As-Tech and looking forward to retirement, Steve engaged Calder Capital to find his successor.

As-Tech was acquired by a privately held metal fabricator looking to grow and expand its territory, locations, and equipment offerings. All employees were retained and all customers will continue to be serviced without change or interruption.

“Steve Greenland is a high quality, high integrity individual, who will assist in the transition, and we were pleased to be able to meet Mr. Greenland’s goals.” the Buyer commented.

Robert Stasiak of Calder Capital served as the lead Mergers and Acquisitions Advisor to As-Tech Industries.

The Calder Capital team orchestrated a strong and swift process, bringing As-Tech to market on August 17th and closing the deal only 120 days later on December 15th. As-Tech garnered interest from 107 qualified buyers and received 5 offers.

“Rob and Calder’s outstanding guidance was pivotal to our sale; their expertise was invaluable,” Steven shared. “The consistent communication and proactive approach ensured we stayed on track throughout the process. Collaborating with Rob was an absolute game-changer for my company; I couldn’t have sold it without him. I trusted Rob every step of the way. I could quickly tell that not only was he good at his profession, but he enjoyed it! He showed critical thinking and discernment, proving to be authentic and genuinely focused on achieving the best outcome for me. He ultimately secured a deal that exceeded our expectations. Rob and the Calder team were essential partners in selling my manufacturing business. I couldn’t be happier with the outcome, and I highly recommend Rob Stasiak and Calder Capital to any business owner seeking top-notch M&A advisory services.”

“Rob and the Calder Team were very good to work with,” shared the Buyer. “They provided information in a very timely manner, were honest and straightforward, and really helped facilitate the transaction, and followed up to assist in a smooth transition.”

“The Buyer is a highly sophisticated investor and industrialist. Steve, the seller, is decisive, proactive, and has strong communication skills. It made for a dream closing,” Rob shared. “I wish continued success to the Buyer and all the best to Steve as he transitions into retirement!”

“Congratulations to the Buyer and Steve on this successful acquisition,” noted Calder Managing Partner, Max Friar. “As-Tech Industries was a meat and potatoes mission for Calder; a retiring manufacturing entrepreneur transitioning his business successfully to a strategic buyer owned by another entrepreneur. It’s the American Dream unfolding right before your eyes. We are looking forward to a very robust year with many more manufacturing acquisitions!”

Calder Capital, LLC served as the exclusive Mergers and Acquisitions Advisor to As-Tech Industries, Inc. Kenton Bednarz of Wolfson Bolton Kochis served as legal counsel to As-Tech Industries, Inc.

The terms of the transaction were not disclosed.

About As-Tech Industries

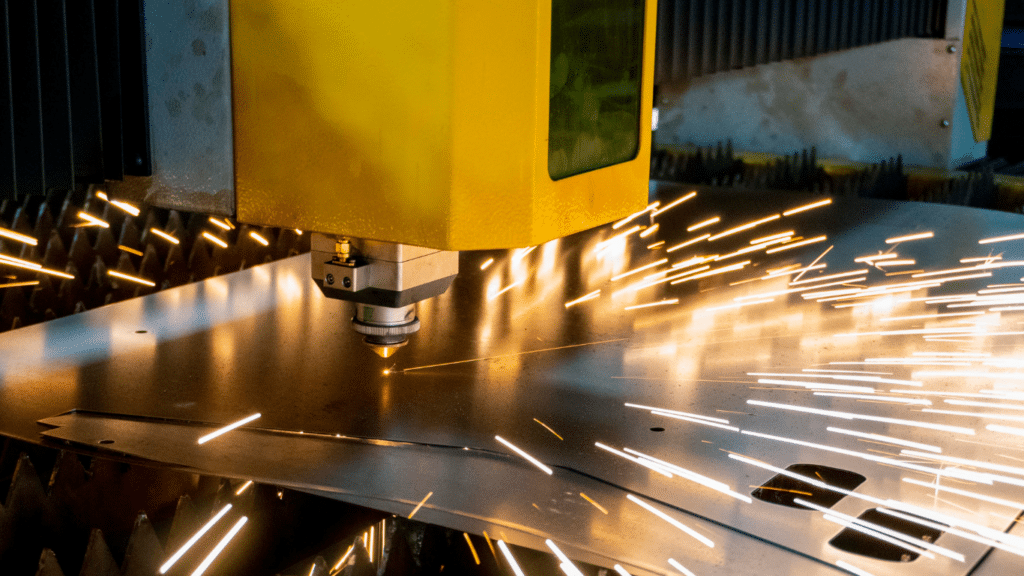

As-Tech Industries is a metal component fabrication shop that offers laser cutting, press brake, CNC punching, and machining services. The Company was founded in 2000 by Steven Greenland. As-Tech is located in Warren, Michigan and has a workforce of 5 employees, all of whom have 15+ years of experience at the company.

About Calder Capital

Founded in 2013, Calder Capital, LLC is a lower middle market investment bank providing mergers and acquisitions advisory services to business owners, entrepreneurs, family offices, and investors across the United States. Our dedicated team of professionals combines extensive industry experience, technological innovation, negotiation savvy, and key relationships to exhibit exceptional execution. Calder’s services include mergers and acquisitions advisory, private funds and capital markets advisory, and business valuations.