If you want to buy/sell in 2022, it’s time to get going in Q1!

We get it, Q1 is a drag. It’s cold in the Midwest, buyers and sellers often take extended vacations to the south, and financials and tax returns need to get done. These factors combine to slow down the start of the year when it comes to getting business owners to engage to sell.

Meanwhile, buyers generally expect and are told that a spring rush will come. This is not to say that they are waiting patiently but it can be tempting to see the next listing that comes out. The grass can certainly look (and sometimes be) greener.

However, if you want to get a transaction done in 2022, it’s time to move.

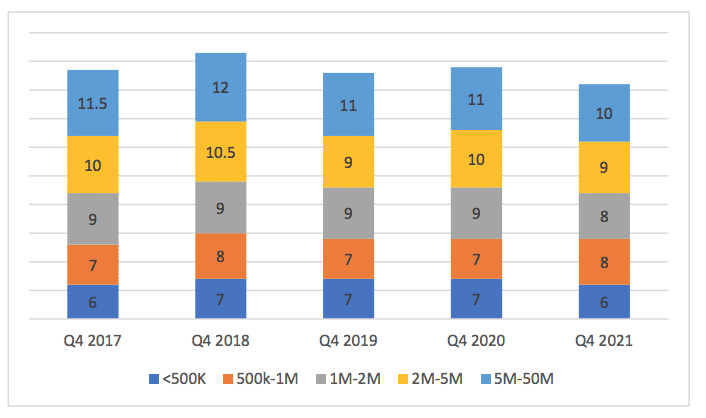

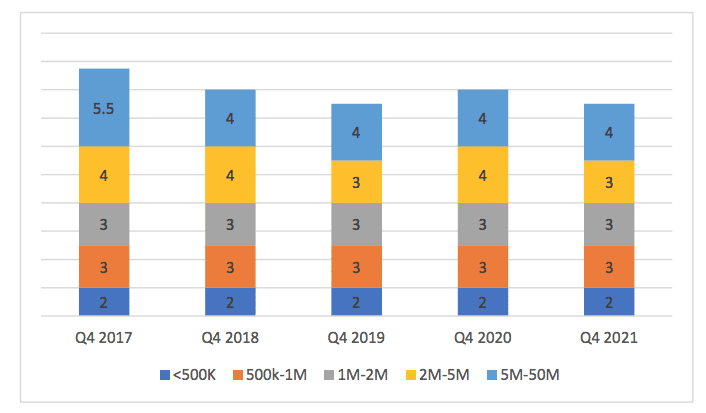

According to the most recent IBBA Market Pulse Report covering Q4 2021, the average time it takes to sell a business is 6-10 months. If you remove the smallest deals (<$500K), it’s 8-10 months.

It’s important to consider the factors that lead to transactions taking this long. When a seller engages with an M&A Advisor, it often takes 30-60 days to get the sale materials prepared. Now, there are some brokers that spend very little time preparing, preferring to take minimal information and go to market quickly. We have found that that leads to information gaps that end up taking up just as much time, if not more, down the road. Additionally, if sale materials are not comprehensive and professionally prepared it reflects on the quality of the Advisor and the seller’s business.

Once on the market, NDAs must be signed, buyers must be qualified, CIMs are sent out, questions are asked/answered, site visits are set up, and offers are made and negotiated. This process takes often 2-3 months and can be faster or slower based on factors such as the geographic location of the business, quality of the financial performance, industry niche, and number and quality of buyers that express interest. At Calder, we firmly believe in showing the market to our clients and therefore are always going to go the extra mile of broad confidential marketing to attract the highest number of qualified buyers.

Once a letter of intent (LOI) is executed between the buyer and the seller, there is significant work to be done and that process will most often take 3-4 months.

Why does it take that long? For most transactions that are <$5MM in enterprise value, the buyer will use SBA 7a financing. When this happens, the bank is going to require a lot of information on the business and the buyer. The buyer will be required to fill out an application, supply a cache of personal confidential information, and undergo a background check. The business itself will be subject to a business valuation, potentially an equipment and real estate appraisal, and Phase I and Phase II environmental assessment (which may lead to issues that need to be cured and/or a Due Care plan).

Beyond these lender requirements, the buyer will conduct often extensive due diligence to verify the business as it was presented. Following due diligence, which often lasts 30-45 days, the buyer will engage legal counsel to prepare a variety of transaction documents – a purchase agreement, employment/consulting agreement for the seller, a lease or real estate purchase agreement, a seller note agreement, and a non-compete agreement among other ancillary agreements. Then the attorneys of the buyer and seller will often have two rounds of redlines on top of numerous calls to negotiate the nuances of the legal documents.

If your goal is to buy or sell a business in 2022, the time to start is Q1 2022. Oftentimes, sellers and buyers approach us in the middle of the year with the express intention of selling or buying before the end of the year. Due to the factors listed above, the realities of the process allow for no guarantees in this respect.

If you would like to discuss buying or selling a business, please contact us.