According to the IBBA Q2 Market Pulse the market is “too hot to touch” with roughly 21% of advisors saying 2018 is the best year they’ve ever seen for business owners to sell their business. Consistent with general market optimism, advisors believe seller advantage is growing consistently as the market stays red hot. Multiples remain high in most categories and in addition to strong valuations, sellers are getting more cash at close this quarter, matched with slight declines in seller financing.

Scott Bushkie, president of Cornerstone Business Services, goes as far as to say, “if you’re thinking of selling in the next three to five years, now is probably the time that you’ll obtain the most value.”

Organic growth remains a challenge as businesses of every size are struggling to find qualified talent. This has led some to pursue inorganic growth as a means to acquire resources and grow their business.

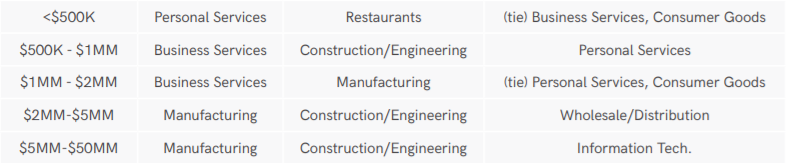

In the lower middle market, manufacturing continues to be highly sought after especially for those companies that produce a proprietary product.

Who’s buying these companies? Existing companies make up a third (33%) of buyers in this sector followed by first time buyers (30%) and serial entrepreneurs (17%). These buyers are motivated both by the opportunity to realize a higher ROI (40%) and to gain a horizontal add-on (30%). Exactly half (50%) of buyers are located more than 100 miles from the seller’s location meanwhile 40% are within 20 miles.

As markets peak however, average time to close is up to 9.2 months an increase from Q2 last year. This likely results from buyers digging deeper and performing more due diligence to make sure they’re getting what they pay for.

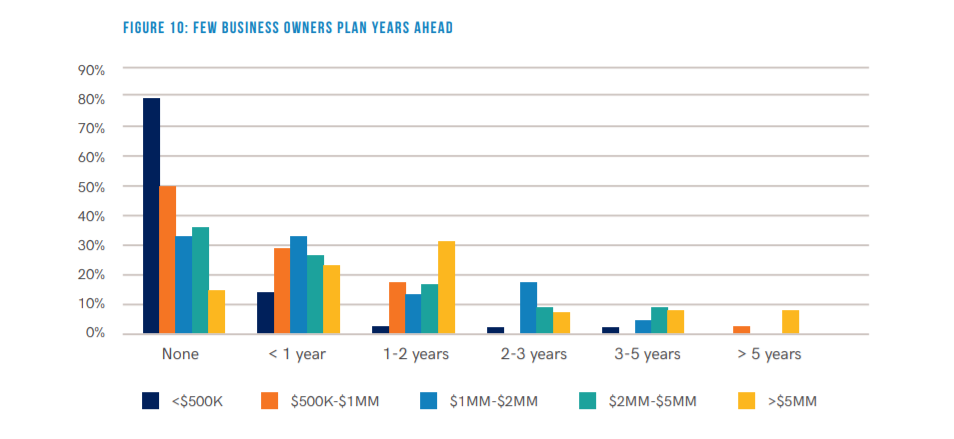

The majority of business owners fail to plan for the sale of their business. Advisors indicate that over 50% of lower middle market business owners conducted no formal planning prior to engagement. Even among business owners that do plan, only a few are working with any kind of professional advisor to discuss exit strategies a year or more in advance.

Whether you are looking to sell your company, grow through inorganic growth or even just begin planning your transition the team at Calder Capital would be happy to talk with you.

Read the full IBBA Q2 Market Pulse Report here: