In a December 2018 blog post we reported that, according to a 2018 Q3 IBBA Market Pulse Report, it was still firmly a seller’s market. In the most recent IBBA and M&A Source Market Pulse Survey for Q4 2018, M&A advisors and business brokers reported that in the Main Street and Lower Middle Market sectors, it was still a seller’s market, but that may not be the case for much longer. Those surveyed report they expect the intense pace of M&A deals to continue into 2019, but not for much longer after that. They expect the deal flow to continue and businesses to keep selling, but deal multiples are not likely to go higher. In fact, the peak for multiples may have already been reached.

What M&A Advisors Report for Q4 2018

The economy’s very low unemployment rate is making companies go the extra mile to acquire skilled labor – that includes acquiring other companies. Currently demand outstrips supply especially in the Lower Middle Market where there is strong competition among buyers for profitable businesses.

“This high demand for labor coupled with strong balance sheets, a positive lending environment, and historically low interest rates are all driving up deal flow and valuations,” said Craig Everett, an assistant professor at Pepperdine.

However, 83 percent of those surveyed did not believe the strong market we have been experiencing will last more than two years. And about a third of them predict that the seller’s market will be over within the year.

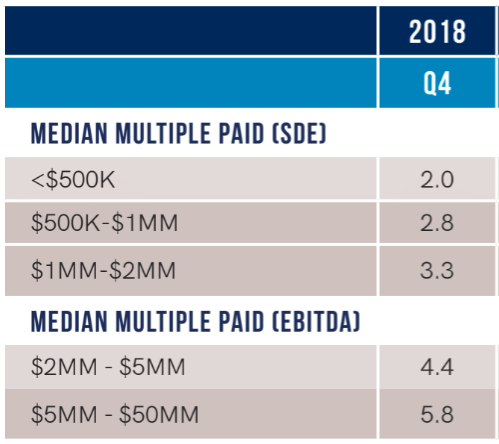

Q4 2018 Deal Multiples

Multiples remained strong across all categories in the Main Street and Lower Middle Market. For some sectors they are at or near peak, matching or exceeding the numbers for 2017. However, advisors do not expect additional multiple growth this year. For deal sizes between $500K and $5MM, the most common multiple type was SDE without working capital. For deal sizes of $5MM-$50MM, the most common multiple was EBITDA including working capital.

The multiples are as follows:

Deal Structures

In Q4 dealmakers were able to find financing without trouble for companies with revenues above $500K. Buyers in the smallest Main Street sector had much more trouble securing financing. Some buyers were not taking full advantage of the funding options available, choosing to borrow less to have a better debt-to-equity ratio, perhaps out of concern for recession.

Sellers were able to get the majority of cash at close in Q4, with those in the $2MM-$5MM sector receiving 78% or more cash at close with the majority of the balance in seller financing and smaller amounts in earn outs and retained equity.

In general, sellers across all deal sizes up to $50MM can generally expect 80% cash at closing, 10% seller note and the balance consisting of earn out and/or retained equity.

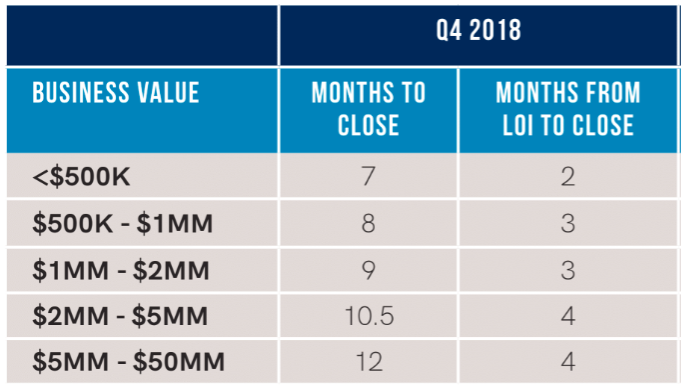

Timeline to Close

Average time to close was 9.3 months in Q4 and about a year for businesses valued between $2-50 million. The average time in months from LOI to close was between 2-4 months, with the number of months growing in direct correlation with the value of the business. For companies valued at $5MM-$50MM, it was 4 month from LOI to close and 12 months total. This is slower than has been typical. Buyers are talking their time doing their due diligence in order to ensure that paying the top dollar that sellers are demanding is justified.

As a whole, business brokers seem to predict that the market is shifting away from sellers to a more balanced market. Deals are taking longer to complete, although financing is still relatively easy to attain. Sellers who wish to get top dollar for the companies might begin the process sooner rather than later to take advantage of the current market.

Time To Closing / Time From LOI to Closing