Small Business Market: < $1MM EV

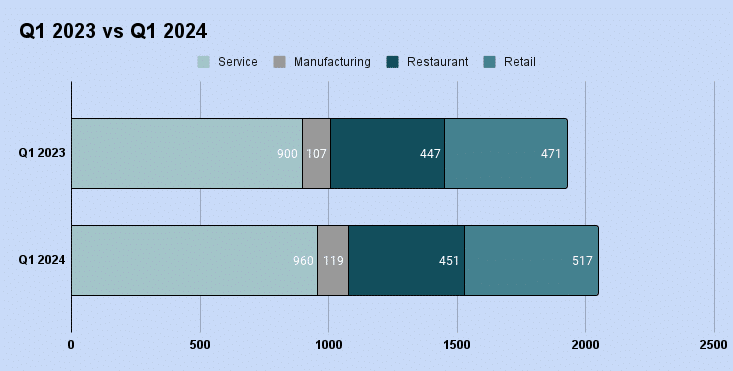

- Small business acquisitons are up 10% year-over-year

- Financials from manufacturing acquisitons show signs of distress

- High-quality companies in the market are anticipated to sustain a considerable level of buyer interest

Various M&A market reports for the first quarter of 2024 provide valuable insights into the latest trends in the small mergers and acquisitions landscape. Calder Capital and Small Business Deal Advisors have also released its financial and closed transaction results for the same period. Reviewing these reports provides prospective buyers and sellers with an understanding of current market conditions for informed business decisions.

Small business acquisitions grew 10% year-over-year in Q1 2024. This indicates market-adjusted confidence among buyers and a potentially favorable climate for small business sales.

Following a mostly stagnant 2023 due to interest rate hikes and economic uncertainty between a recession and a soft landing, deal activity seems to be picking up again. According to a recent Federal Reserve survey, U.S. banks are predicting higher loan demand in 2024. Despite this, with inflation remaining above the Federal Reserve’s 2% target, Fed Chair Jerome Powell has indicated that rate cuts are unlikely anytime soon.

Max Friar, managing director of Calder Capital, comments, “The memory of low rates is fading, and the reality of higher rates (well into the future) is helping everyone get present to reality. The (finally) largely sensible changes that the SBA has made regarding partial ownership and loosening the rules around seller financing are solid attempts to widen the buyer pool.”

According to BizBuySell, transaction levels are still 5% below those seen in 2019 before the pandemic. Deal-making has become more cautious, with buyers and sellers carefully assessing prices and terms to align better with the market. Now, 27% of sellers are open to including some form of seller financing, up from 22% last year, which is favorable for buyers, as 85% consider seller financing important.

As buyers and sellers adapt to current market conditions, transaction activity is anticipated to increase. With interest rates unlikely to decrease until the latter half of the year, if at all, there is less incentive for buyers and sellers to remain on the sidelines.

“My prediction is that seller activity will pick up in Q2 and Q3, leading to a very robust Q4 2024 and Q1 2025 in terms of closings. I also feel that, barring any major economic disasters, 2025 will be a very strong year for sellers engaging to sell. This is because: a) seller sentiment will continue to tick up; b) rates may finally start to tick down; and c) there will be clarity on the 2024 election results and therefore policy decisions affecting the economy for the next four years.” -Max Friar, Managing Partner

According to the BizBuySell Insight Report for Q1, several factors are adding stress for business owners:

- Inflation: 70% of surveyed owners report that inflation is not easing.

- Payroll Costs: 29% of small business owners struggle with payroll costs, with some claiming these expenses consume 50-60% of their revenue.

- Wages: Despite 81% of small business owners already paying above minimum wage, 44% say that rising minimum wages have negatively impacted their business.

- Staffing: Nearly half (47%) of understaffed businesses are having trouble attracting qualified applicants.

These challenges highlight the ongoing difficulties faced by small business owners in maintaining profitability and sustainability. As they navigate these issues, many are seeking innovative solutions and support to manage their operational costs and workforce needs.

“Many baby boomers are simply feeling worn out and ready to sell, economic worries aside. Those who weathered the storm of the Great Recession and the pandemic have become adept at adapting and are doing so whenever possible.” -Hannelore Green, Continuous Improvement Director

The manufacturing sector continues to show robust activity in acquisitions, with closed transactions increasing by 11% compared to the previous year. However, this represents an 8% decline from the previous quarter. One of the most significant trends reported by BizBuySell is the sharp decline in median sale prices, which have dropped by 20% year-over-year and 21% from the previous quarter. This is the steepest decline since Q2 2022.

Financials for manufacturing businesses sold in Q1 reveal some challenges. Median revenue has decreased by 11% from the previous quarter and 8% from the previous year. Additionally, median cash flow has seen a substantial drop of 25% quarter-over-quarter and 17% year-over-year. These figures suggest that buyers might be increasingly viewing these businesses as distressed assets with potential for turnaround through new strategic objectives and investments.

Calder’s Managing Partner, Max Friar commented, “We are seeing pockets of distress. It is hard to believe, but PPP (Paycheck Protection Program), ERC (Employee Retention Credit), and EIDL (Economic Injury Disaster Loan) programs have continued to prop up many companies. We are seeing more of those that are likely to not make it on their own. As a result, we have beefed up our distressed practice.”

Despite the economic uncertainty, a significant interest persists among buyers seeking businesses that have showcased resilience and success in tough market conditions.

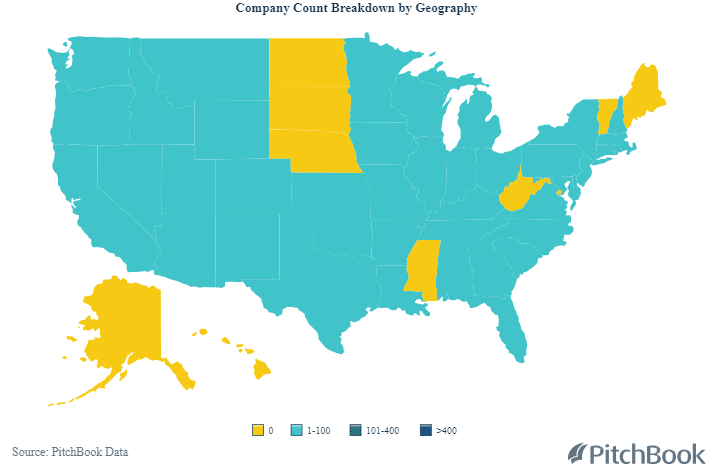

Calder Capital typically assists businesses with enterprise values exceeding $1MM. Small Business Deal Advisors, LLC is a sister company with common ownership that offers a discounted commission M&A service offering for smaller businesses. If you would be interested in learning more or listing your business through SBDA, please visit the Small Business Deal Advisors website.

If you would like to view Small Business Deal Advisors’ Listings, please do so here: Small Businesses for Sale.

About Market Update:

Calder Capital’s market updates pull the most recent data provided through industry-wide market reports including the IBBA Market Pulse, BizBuySell, as well as Calder’s internal transactions. Calder takes this information and compiles it into a short report providing insights into current market conditions. Calder’s market update is published each quarter, following the publication of the materials it sources. Our firm’s experience of closing over 40 annual transactions provides us with a uniquely accurate perspective on current market conditions. We offer valuable insights and analysis on market segments that can inform strategic decision-making for businesses considering buying, selling, or merging. Our actionable advice is backed by real-world data and a deep understanding of the complex nuances of the mergers and acquisitions landscape, and we take pride in providing exceptional service to our clients.

Lower Middle Market: $1-10MM EV

- 2024 deal activity is up in Q1 over 2023.

- High-quality companies in the market are anticipated to sustain a considerable level of buyer interest.

- Seller sentiment is on the rebound following a dim outlook in 2023.

Newly published 2024 Q1 market reports offer valuable insights into current trends in the mergers and acquisitions market. Additionally, Calder Capital has reported its first-quarter financial and closed transaction results. By examining these reports, potential buyers and sellers can gain a better understanding of the current market conditions and make informed decisions regarding their business strategies.

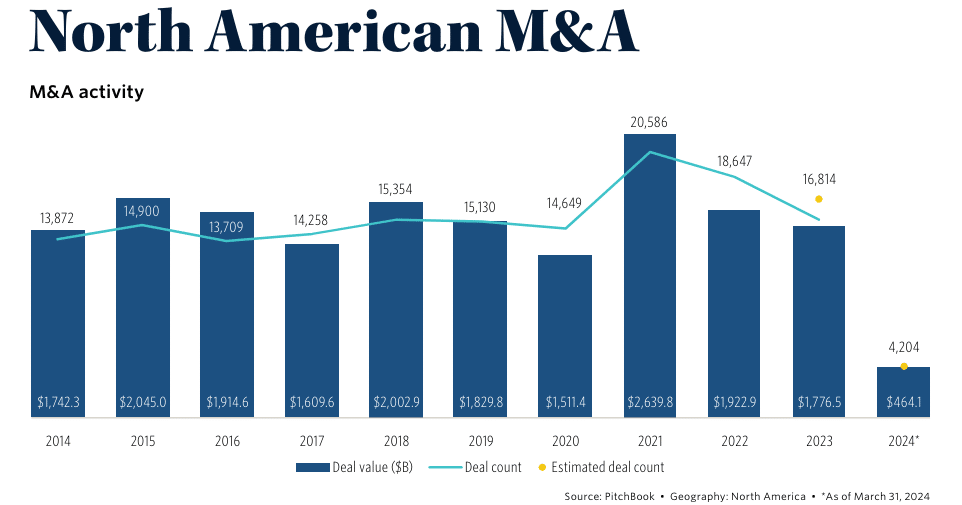

The outlook for 2024 remains uncertain due to factors like economic volatility, geopolitical tensions, increased regulatory scrutiny, supply chain disruptions, and upcoming elections. However, buyers and sellers have shown strong resiliency. According to PitchBook data Global M&A The total M&A value for Q1 totaled $464.1 billion, marking a robust increase of 9.7% year over year, yet this was a decline sequentially of 18.4% quarter over quarter, partially due to seasonal factors.

Following dim seller sentiment in 2023, Q1 2024 revealed an uptick in market confidence according to the IBBA Market Pulse Report. High demand and low supply are driving a sellers’ market. Sellers that are choosing to sell presently are receiving a lot of attention from buyers.

With pent up buyer demand, sellers and buyers are more willing to explore creative deal making solutions. The IBBA reported deals completed in Q1 in the $5-$50 million sector included on average 15% in the form of seller financing. Calder’s team also noted an increase in the use of earnouts to bridge valuation gaps in the first quarter.

In late July 2023, the Federal Reserve raised interest rates for the 11th occasion since March 2022, resulting in the target federal funds rate spanning 5.25% to 5.50%. According to ADP, the private sector added 497,000 jobs in the month of June, more than double the Dow Jones consensus estimate of 220,000. The lack of progress in the Fed’s goal of cooling the job market is an influential factor in additional hikes.

With buyers and sellers having just short of a year to adjsut to the current rate environment, activity is predicted to increase in Q2 2024. According to PitchBook, the biggest lag in activity comes from Private Equity buyers as dealmaking has been stunted by high borrowing costs.

According to Q1 research from Pitchbook and PWC, the breakdown of M&A deals in the $1-10MM space saw a mix of private equity (PE), strategic, and individual buyers. According to the data, private equity buyers accounted for approximately 38% of these transactions. Strategic buyers, including corporate acquirers looking to expand their market presence or acquire new capabilities, made up around 42% of the deals. Individual buyers, often high-net-worth individuals or family offices, comprised the remaining 20%.

These figures reflect the ongoing trend of strategic buyers leading the market, with private equity firms remaining active despite some market challenges. Individual buyers continue to play a significant role, particularly in the lower middle market where deal sizes are more accessible.

PwC’s 27th Annual Global CEO Survey revealed that 60% of CEOs plan to make at least one acquisition in the next three years. Companies are undergoing significant changes due to global trends like digitalization and decarbonization. To stay competitive, Companies are re-evaluating strategies and exploring acquisitions to scale, access new technology, and grow faster. Alternatively, businesses may divest non-core or underperforming assets to focus resources on key growth areas.

According to PitchBook data, in Q1 2024, the US M&A market experienced a significant number of distressed transactions within the manufacturing sector. Economic uncertainty, high interest rates, and inflation have driven business owners to sell under distressed conditions, creating more opportunities for distressed sales.

Q1 Data for Distressed Manufacturing M&A Transactions in the US

Calder’s Managing Partner, Max Friar commented, “We are seeing pockets of distress. It is hard to believe, but PPP (Paycheck Protection Program), ERC (Employee Retention Credit), and EIDL (Economic Injury Disaster Loan) programs have continued to prop up many companies. We are seeing more of those that are likely to not make it on their own. As a result, we have beefed up our distressed practice.”

While transactions have remained resilient in the $1-10MM EV sector, it’s crucial to uphold a proactive approach amidst economic uncertainty. Strategies such as evaluating potential methods to bridge valuation gaps and implementing creative closing structures with earn-outs or seller notes can expedite timelines, enhance closure certainty, and increase overall value.

No matter the complexities of your transaction, Calder’s experienced Buy-Side & Sell-Side teams are equipped to guide you through the process, ensuring that you make informed decisions and employ expertise to cross the finish line.

Overall, the M&A landscape showcases a complex interplay of factors that are shaping the decisions and sentiments of buyers and sellers alike.

About Market Update:

Calder Capital’s market updates pull the most recent data provided through industry-wide market reports and resources including the IBBA Market Pulse, the PWC Global M&A Industry Trends Report, the ADP Employment Report, the White House’s briefings, as well as Calder’s internal transactions. Calder takes this information and compiles it into a short report providing insights into current market conditions. Calder’s market update is published each quarter, following the publication of the materials it sources. Our firm’s experience of closing over 40 annual transactions provides us with a uniquely accurate perspective on current market conditions. We offer valuable insights and analysis on market segments that can inform strategic decision-making for businesses considering buying, selling, or merging. Our actionable advice is backed by real-world data and a deep understanding of the complex nuances of the mergers and acquisitions landscape, and we take pride in providing exceptional service to our clients.

Middle Market: >$10MM EV

- M&A activity for businesses in the >$10MM EV sector has slowed.

- 2024 Q1 saw transaction volume decrease ~35.4% YoY in the $50MM+ sector.

- Consumer M&A activity in the $50MM+ sector continues to drop.

Recently released market reports for Q1 2024 provide insight into prevailing trends within the mergers and acquisitions landscape. Furthermore, Calder Capital reported its third -quarter financial and closed transaction results. Reviewing these resources assists prospective buyers and sellers in deepening their understanding of the present market dynamics, enabling them to make well-informed choices about their business approaches.

M&A activity for businesses in the >$10MM EV sector continues to slow. Reports from across the market illustrate that deal value and volume have weakened the larger a deal was in Q1 2024.

According to KeyBanc’s M&A Quarterly Report, Q1 2024 announced transaction volume decreased 35.4% year over year. Activity remained muted in the quarter as high interest rates, prevailing economic uncertainty, and a lack of meaningful deal flow all contributed to a soft M&A market.

Value and volume decrease in the Middle Market are believed in part to be linked to the existing lending environment. Buyers have to consider alternate financing options and work much harder to come up with the necessary funds to execute transactions. Many buyers are paying much more in interest now, resulting in lower offers and hesitation.

Due to tightening debt markets and escalating expenses, platform buyouts faced heightened challenges. As a result, bigger corporations are increasingly concentrating on the small business and lower middle market sectors for add-on acquisitions.

The trajectory of deal activity is anticipated to align closely with the overall state of the economy for businesses in the Middle Market sector. However, quality companies on the market are expected to continue to attract a high level of attention.

“Despite the headlines of ‘doom and gloom’, we are seeing businesses that have maintained or improved performance through recent years achieving higher than typical levels of interest and selling for healthy multiples. The market remains strong for resilient businesses, specifically in the manufacturing, distribution, and business services sectors.” – Jake McDonald, Calder Capital M&A Advisor, Chicago, IL

Calder Capital reported a significant surge in buyer interest in the market. In Q1, the Sell-Side team received a record number of offers, surpassing the previous high of 28. Clients received 32, 49, and even 53 offers. Additionally, there were weeks when prospective buyers requested over 1,000 Confidential Information Memorandums (CIMs) for sell-side clients. The team successfully closed 12 transactions in Q1. Sellers considering selling their businesses are attracting substantial attention from buyers.

$5MM-$50MM EV

The outlook for 2024 remains uncertain due to factors like economic volatility, geopolitical tensions, increased regulatory scrutiny, supply chain disruptions, and upcoming elections. However, buyers and sellers have shown strong resiliency.

Following dim seller sentiment in 2023, Q1 2024 revealed an uptick in market confidence in the $5-50MM sector according to the IBBA Market Pulse Report. High demand and low supply are driving a sellers’ market. Sellers that are choosing to sell presently are receiving a lot of attention from buyers.

With pent up buyer demand, sellers and buyers are more willing to explore creative deal making solutions. The IBBA reported deals completed in Q1 in the $5-$50MM sector included on average 15% in the form of seller financing.

PwC’s 27th Annual Global CEO Survey revealed that 60% of CEOs plan to make at least one acquisition in the next three years. Companies are undergoing significant changes due to global trends like digitalization and decarbonization. To stay competitive, Companies are re-evaluating strategies and exploring acquisitions to scale, access new technology, and grow faster. Alternatively, businesses may divest non-core or underperforming assets to focus resources on key growth areas.

$50MM+ EV

Impacted by high interest rates and post-pandemic challenges, 2024 Q1 saw transaction volume decrease 35.4% YoY, according to Keybanc Capital Markets’ Quarterly Report.

The report also indicated that Consumer M&A activity has continued to decline, with valuations also decreasing to below historical levels. Sales volumes have remained muted, primarily due to buyer caution in a challenging rate environment. In Q1 2024, M&A deal activity and valuations in the industrial sector declined due to ongoing inflationary pressure and economic uncertainty. Industrial companies are increasingly engaging in joint ventures, potentially enabling more transformative deals throughout the year.

While the current economic climate remains uncertain, there is still significant interest from buyers in acquiring healthy businesses that have proven their resilience and strength in the face of adversity.

About Market Update:

Calder Capital’s market updates pull the most recent data provided through industry-wide market reports and resources including the IBBA Market Pulse, the PWC Global M&A Industry Trends Report, the ADP Employment Report, the White House’s briefings, as well as Calder’s internal transactions. Calder takes this information and compiles it into a short report providing insights into current market conditions. Calder’s market update is published each quarter, following the publication of the materials it sources. Our firm’s experience of closing over 40 annual transactions provides us with a uniquely accurate perspective on current market conditions. We offer valuable insights and analysis on market segments that can inform strategic decision-making for businesses considering buying, selling, or merging. Our actionable advice is backed by real-world data and a deep understanding of the complex nuances of the mergers and acquisitions landscape, and we take pride in providing exceptional service to our clients.