For business owners of struggling manufacturing and construction businesses, deciding how to exit a struggling business can be challenging. The two primary options are:

- M&A Business Sale: Selling the company as a going-concern (selling the business while it's operating), creates an opportunity to attract interest from buyers who view the entire business as valuable vs just the hard assets.

- Liquidation Auction: Liquidating the assets through an auction, ensuring a quick sale but potentially sacrificing additional value that could be captured in a broader sale process.

The best choice depends on urgency, market conditions, and the financial stability of the business. An M&A business sale, like Calder Capital performs, maximizes the opportunity for competitive pressure and confidentiality, which may result in higher pricing while preserving control over the sale process.

Calder Capital’s relationships with distressed buyers and a 200,000+ buyer database make a going-concern sale a high-certainty option, while liquidation auctions remain guaranteed but often yield lower returns.

This analysis provides a comparison of M&A business sales vs. liquidation auctions. As a lower Middle Market M&A broker, we believe in informing business owners on sales frameworks, so that they may make the best decision for themselves, their families, and their communities.

Financial Comparison: Liquidation Auction vs. M&A Business Sale

While owners often focus on headline sale price, the proceeds they receive upon closing are impacted by auction fees, buyer discounts, and market demand. Below is a financial comparison using a manufacturing company with $2M in fair market value (FMV) equipment, incorporating industry-standard recovery rates.

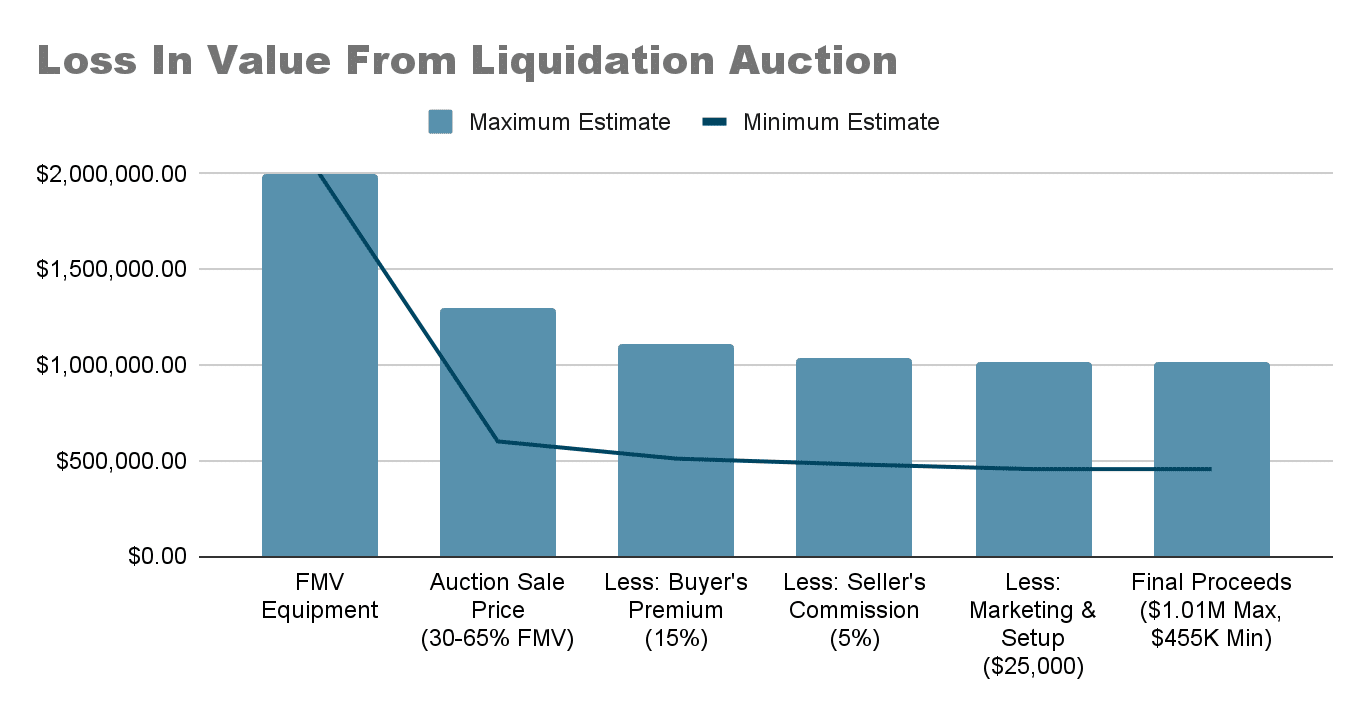

Auction Liquidation: Fees and Net Proceeds

Auction houses charge fees in three primary ways:

- Buyer’s Premium (15-18%) – Added cost to buyers, reducing what they are willing to bid.

- Seller’s Commission (0-10%) – Deducted from the seller’s proceeds.

- Marketing & Setup Costs – Typically $10,000-$30,000, deducted from final proceeds.

The biggest risk in an auction is the final sale price of assets.

- Industry data suggests that forced liquidation auctions recover 30–65% of FMV, depending on asset type:

- Heavy Manufacturing Equipment (CNC machines, presses, fabrication tools, etc.): 50–65% of FMV.

- Specialized or Niche Equipment: Often under 50% of FMV due to limited buyer demand.

- The linked study finds that non-financial firms' assets are generally highly specific, with an average recovery rate of 35% for plant, property, and equipment (PPE).

- Office Furniture & Fixtures: As low as 10-20% of FMV.

Example: Manufacturing Business with $2M in FMV Equipment

- Auction Sale Price Estimate (30-65% FMV) → $600,000 - $1,300,000

- Less: Buyer’s Premium (15%) → $510,000 - $1,105,000

- Less: Seller’s Commission (5%) → $484,500 - $1,049,750

- Less: Marketing & Setup ($25,000) → $459,500 - $1,024,750 (Final Net Proceeds)

Results:

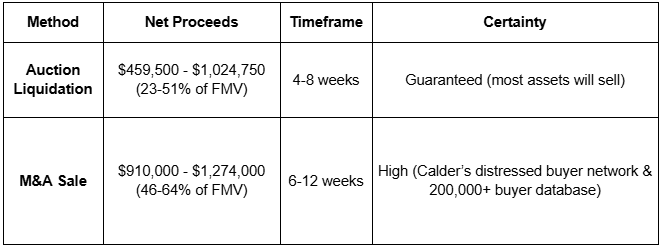

- Final Net Proceeds: $459,500 - $1,024,750 (23-51% of FMV)

- Time to Completion: 4-8 weeks

- Certainty: Guaranteed (Assets will sell, though price is uncertain)

An auction ensures a quick exit, but deeply discounts value - often leaving owners with <50% of FMV due to liquidation-sale conditions.

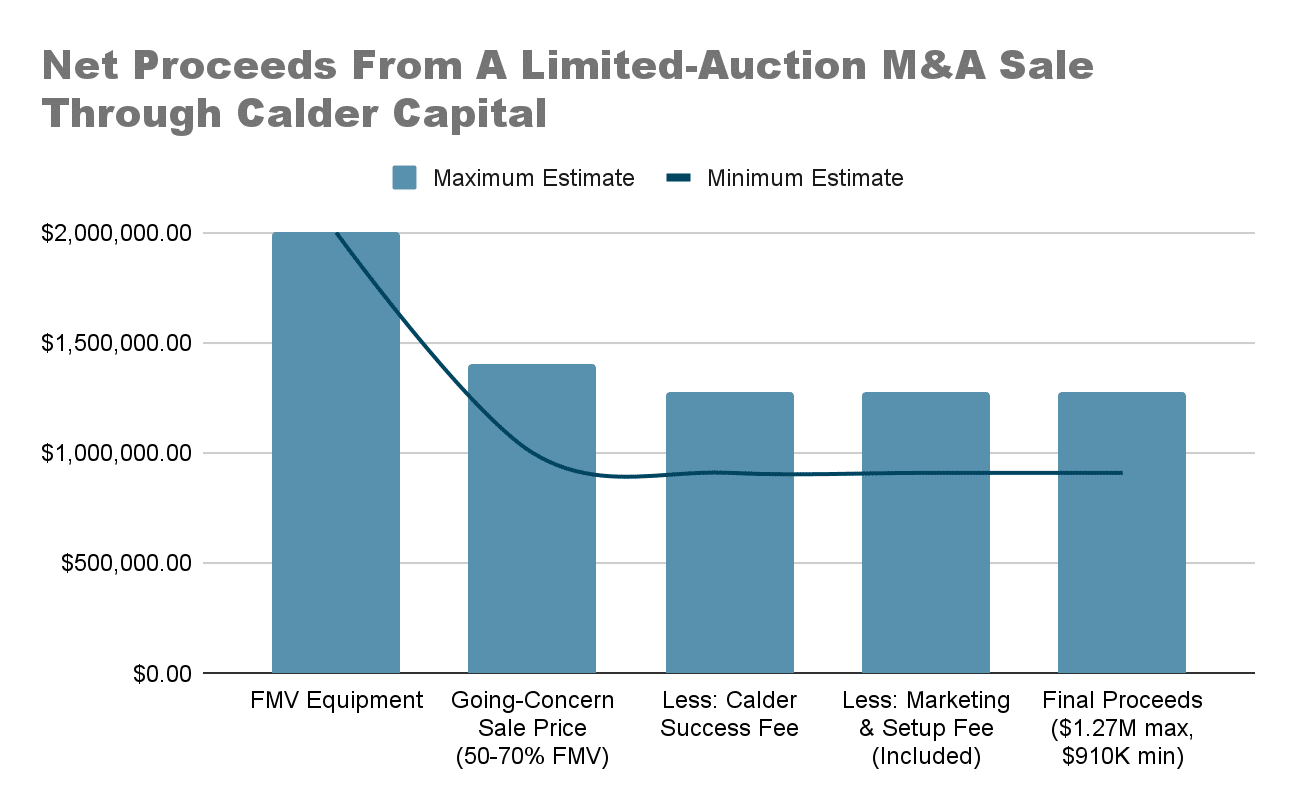

M&A Business Sale: Fees and Net Proceeds

Calder Capital’s M&A business sale process follows a different structure from a liquidation auction process. Please note that the deal fees quoted here are relative to the example of a manufacturer selling a $2M appraised FMV business as a going-concern (selling the business while it's operating) with Calder Capital as the Sell-Side M&A Broker.

- Monthly Work Fee ($5,000 fully-credited at closing)

- Success Fee (9% of the final purchase price).

- No Buyer’s Premium (buyers bid at full value).

This approach creates the opportunity for buyers to see beyond asset value and consider potential intangibles such as customer contracts, workforce, and goodwill. However, not all buyers will place material value on these factors - and when they do, it depends on the competitiveness of the process and the perceived sustainability of the business.

- Based on distressed sale benchmarks, businesses in this category typically sell for 50-70% of FMV.

- An M&A process increases the chances of attracting multiple bidders, which in turn increases the likelihood of an outcome closer to the high end of the range.

Example: Manufacturing Business with $2M in FMV Equipment

- Going-Concern Sale Price Estimate (50-70% FMV) → $1,000,000 - $1,400,000

- Less: Calder Success Fee → $910,000 - $1,274,000

- Less: Marketing & Setup (included in work fee) → $910,000 - $1,274,000 (Final Net Proceeds)

Results:

- Final Net Proceeds: $910,000 - $1,274,000 (46-64% of FMV)

- Time to Completion: 6-12 weeks

- Certainty: High (Leveraging Calder’s distressed buyers & 200,000+ buyer database)

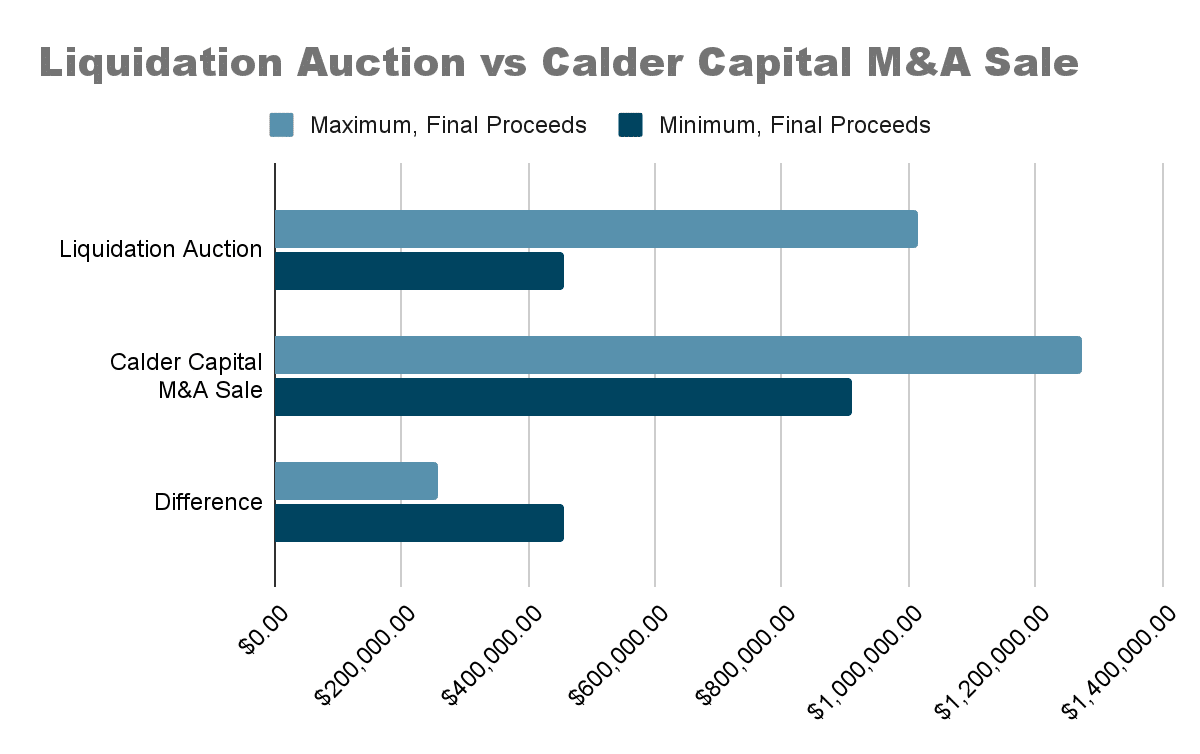

Comparing the Outcomes:

Key Takeaway:

While an auction provides speed and a guaranteed sale of assets such as property and equipment, it limits potential sales value - often leaving owners with significantly lower proceeds than a competitive, confidential sale process. An M&A business sale provides a high-certainty alternative that has historically achieved higher recovery values for Calder Capital clients.

Other, Non-Financial Considerations

Beyond the financial considerations, the decision to sell a business encompasses profound emotional and social dimensions that significantly impact the owner, employees, customers, and the broader community.

Preserving the Owner's Legacy

For many entrepreneurs, a business represents more than just a source of income; it embodies years of dedication, innovation, and personal sacrifice. Choosing to sell the business as a going concern dramatically increases the odds that the owner's vision and values to endure, ensuring that the company's identity and reputation remain intact under new stewardship. This continuity can be a source of personal pride and fulfillment, knowing that the foundation they've built will continue to thrive.

Safeguarding Employment and Community Stability

A going-concern sale typically ensures that much of the workforce remains employed, maintaining job security and morale. This stability extends to the community, as the business continues to operate, support local economies, and uphold relationships with suppliers and customers. In contrast, liquidation often leads to job losses and economic disruption, affecting not only the employees but also their families and the community at large.

Maintaining Customer Relationships and Brand Loyalty

Selling the business as an ongoing entity ensures that customers experience uninterrupted service, preserving the goodwill and brand reputation cultivated over time. This seamless transition reinforces customer confidence and sustains the revenue streams essential for the business's continued success.

Emotional Considerations

The emotional toll of closing a business through liquidation can be significant for owners who have invested considerable time and resources into building their enterprise. Witnessing the dissolution of their efforts can be challenging. Conversely, facilitating a sale that allows the business to continue can provide a sense of closure and satisfaction, knowing that their legacy will persist.

Why an M&A Business Sale May Attract Higher Bids

Unlike liquidation, an M&A business sale allows for competition among strategic, entrepreneurial, and financial buyers, potentially leading to:

- Multiple offers competing for the business.

- Buyers who may see value in customer relationships or workforce continuity.

- Greater deal flexibility (earn-outs, tax-optimized structures).

That said, not all businesses will achieve a significant premium over asset value through an M&A business sale. The degree to which buyers assign value to intangible assets varies, but a well-run sales process maximizes the likelihood of a strong result.

“We weren’t sure if buyers would care about our contracts and team, but once multiple bidders engaged, the offers exceeded what we expected.”

-Tom, a construction business seller and client of Calder Capital

Conclusion: Balancing Speed, Value, and Certainty

- Liquidation Auction: Offers a fast, guaranteed exit, but often at steep discounts (typically 23-51% of FMV).

- M&A Business Sale: Potential for 46-64% of FMV, with buyer competition playing a key role, and a completion timeline only slightly longer than an auction (historically for Calder Capital, this may take 2-4 weeks longer than a liquidation auction).

For owners under severe time constraints, an auction provides certainty. But for those with 6-12 weeks to run a competitive process, a M&A sale offers the best opportunity for maximizing proceeds while keeping liquidation as a fallback.

Your business may be worth more than just its parts - don’t leave potential value on the table. Contact us today for a confidential discussion.