Interest rates are rising quickly. In fact, rates in 2022 have risen twice as fast as the rate hike cycle of 1988-1989! Given this, many investors, buyers, and sellers of businesses are asking, “What impact is the rising rate environment having on mergers and acquisitions financing?”

One logical conclusion that you could draw is that it’s getting harder to finance transactions for a number of reasons: seller expectations of valuation typically remain elevated, lenders lose their appetite to lend heading into potential recession, and debt service coverage ratios become harder to attain as profits are squeezed and a rising rate environment forces more of those profits to pay for interest. So, are transactions slowing down?

Let’s take a look at what’s been happening in 2022 and then try to gauge what may transpire heading into 2023.

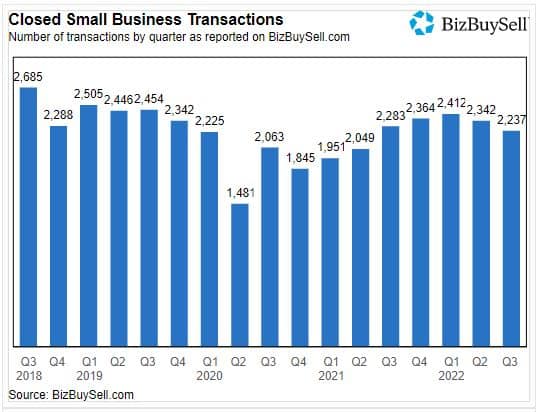

Throughout 2022, while Calder’s pace of closing transactions has not slowed, we have witnessed a very gradual slowdown of transactions in the broader market. For example, bizbuysell.com’s recent Insight Report notes that “The number of closed deals reported in Q3 dropped 2% year-over-year to 2,237, and was 4.5% lower than the number reported in Q2.” You can see the gradual decline in this graph, which shows the number of businesses sold in each quarter since 2018.

These are mostly smaller Main Street businesses with enterprise value of <$1M. What is happening with larger transactions? According to the most recent IBBA Market Pulse, “For businesses with enterprise value of $5 million to $50 million…those businesses received valuations at 102% of benchmark, even as multiples declined from their peak.” Additionally, regarding deal structure, the report noted “Financing structures remain relatively consistent year over year. In depressed market conditions, we would expect to see an uptick in seller financing and earnouts. That has not materialized yet.”

Calder’s experience in 2022 essentially corroborates what the market has experienced broadly this year. For us, it’s been game on; sellers and buyers want to transact. We are up fairly significantly this year, however, we are always grinding harder than other market players.

So let’s try to take a look into the future. To do this, we interviewed a few of our trusted lending partners to ask them what advice they are giving to buyers and sellers, and what they are hearing internally. It’s critical to understand what lenders are feeling because they are ultimately the lynchpin in most transactions.

To give some context, most of these folks are SBA 7a lenders. The present rules dictate that the buyer brings 5% cash equity to the transaction at a minimum. For years now, we have seen lenders preferring and mostly requiring 10% from the buyer. A rule of thumb for the past few years has been 10-10-80, with 10% seasoned cash equity from the buyer, a 10% seller note, and 80% senior lender. So, the seller would get 90% cash at closing and hold a 10% note.

As you will read below, there is some pressure building where the seller will be asked to finance more of the transaction (to maintain a higher valuation) due to the restrictions on cash flow that higher rates are providing.

We asked the lenders the following question, “Given the rising rate environment, are there any points that you feel are particularly important for buyers/sellers to understand right now when approaching a transaction?”

Here is a synopsis of their responses.

Lender 1

“For buyers, I emphasize that we’ve been spoiled with an abnormally low-rate environment. I focus on the fact that the Wall Street Journal Prime rate today is at its historical average of 7%. We also discuss that although we have no “crystal ball,” historically when the rates rise at a rapid pace they will fall back to historic lows within a 2-3 year period.

For sellers, we’re seeing the need for a seller to carry roughly 12-15% more paper to achieve the sale at the valuation from earlier in the year. OR – sellers are accepting the rising rate environment will require them to sell at a 12-15% lower price if they are unwilling to carry the subordinated paper for their buyer.”

Lender 2

“The trend I am noticing lately is that sellers have not necessarily changed their price/multiple expectations but the debt coverage ratios are being dramatically impacted since rates are up about 300 basis points from this point last year.

So, to bridge the gap, I have been suggesting more seller financing so they can hopefully achieve their price yet get the deal mostly financed. To sweeten this structure, I also suggest that after two years of timely payments on the seller note(s), we can then come back and consider refinancing these seller notes.”

Lender 3

“Higher interest rates do tighten overall cash flow. As a result, there may be a need depending on the transaction for an additional equity contribution and/or larger seller notes. This would all be considered on a case-by-case basis as each deal has many nuances.

As we move into this recession the bank thinks we may see 10% down and 20% seller note.

Having some personal liquidity post-equity contribution to the business is essential when heading into a recession. Any bank will want to see some reserves to ensure the buyer isn’t too leveraged.”

Conclusion

Given the trend we are seeing via bizbuysell.com, continued rising rates, continued high inflation, and growing risks of a recession, it seems reasonable to assume that the pace of transactions will continue to trickle down slowly. Additionally, based on studying deal structures during a tougher economic period and our interviews with lenders, it is reasonable to expect that sellers will be asked to finance more of the transaction in order to get it to the finish line. While sellers will not like this, it is entirely rational as a way to mitigate risk and also as a way to buoy valuation. After all, financing more of the transaction leaves cash flow to service rising senior debt interest.

The good news is that the American entrepreneur will not be stopped; buyers will buy. Additionally, the many remaining Baby Boomer business owners are growing more and more tired. Per the Market Pulse, “Many sellers go to market when they’re tired or burned out. Business owners haven’t had a ‘normal’ year since 2019. With headwinds still ahead, we could see a lot more Boomers calling it quits rather than weather any more unpredictability.”