Calder is assisting a strategic buyer in acquiring a business within K-8 STEM education. Specifically of interest are companies with STEM programs focused on manufacturing and engineering. Our buyer is also open to digital media and business insights companies.

Ideally, the target company is generating up to $10M in revenue and is located in the United States.

Acquisition Criteria:

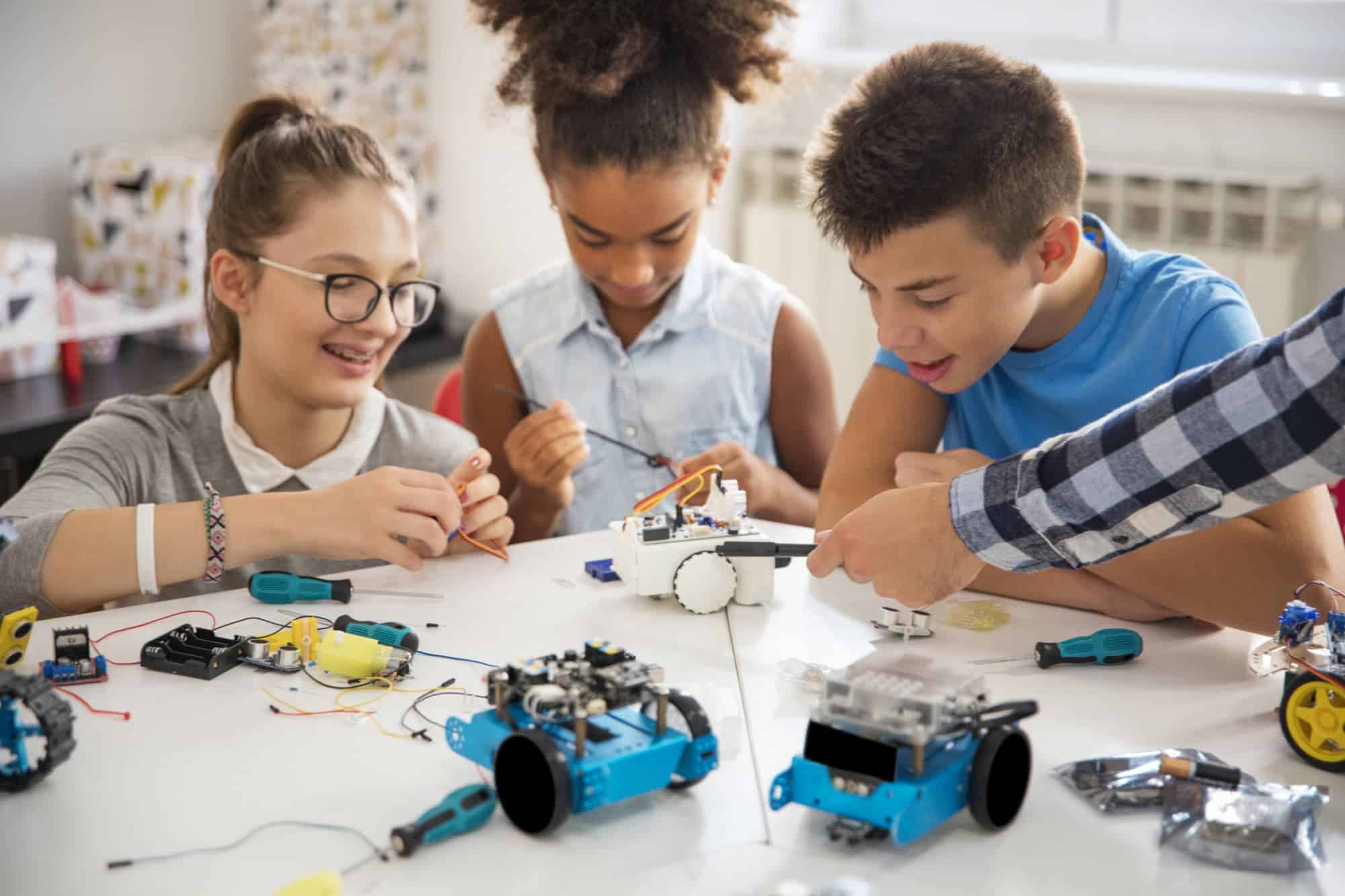

Target: K-8 STEM education ideally with a curriculum related to manufacturing and/or engineering.

Geography: United States.

Revenue: Up to $10M.

About Our Client:

For nearly 100 years, our buyer has been driving North American manufacturing competitiveness, resiliency, and national security. They see a future where manufacturing is a thriving, diverse, and highly valued industrial ecosystem that offers people tremendous opportunities for lifelong careers. Our buyer is on a mission to help the industry accelerate the adoption of advanced manufacturing technologies and build the necessary, sustainable talent pipeline.

Our buyer collaborates with thousands of manufacturing companies from Fortune 500 manufacturers to small and midsize companies and is engaged with over 1,000 educational institutions. Their proven ability to scale innovative workforce solutions, supported by partnerships with government agencies, nonprofits, and other like-minded organizations, positions our buyer as a key player in addressing the manufacturing talent crisis and creating long-term value for the industry.

This acquisition represents a strategic expansion for our buyer’s efforts to integrate manufacturing exposure and skills development programs across the educational ecosystem. By integrating the acquired business into their existing services, our buyer aims to broaden their national footprint, introduce middle and elementary school students to manufacturing technologies, and further strengthen the talent pipeline. Being in business for nearly a century, and with a leadership team of more than 100 years of combined expertise, our buyer offers unparalleled resources to sustain and grow the legacy of any acquired company.

If you are interested or know of a potentially interested party, please fill out the confidentially connect form or contact:

Hannah Nabhan

Direct: 219-841-2064

[email protected]