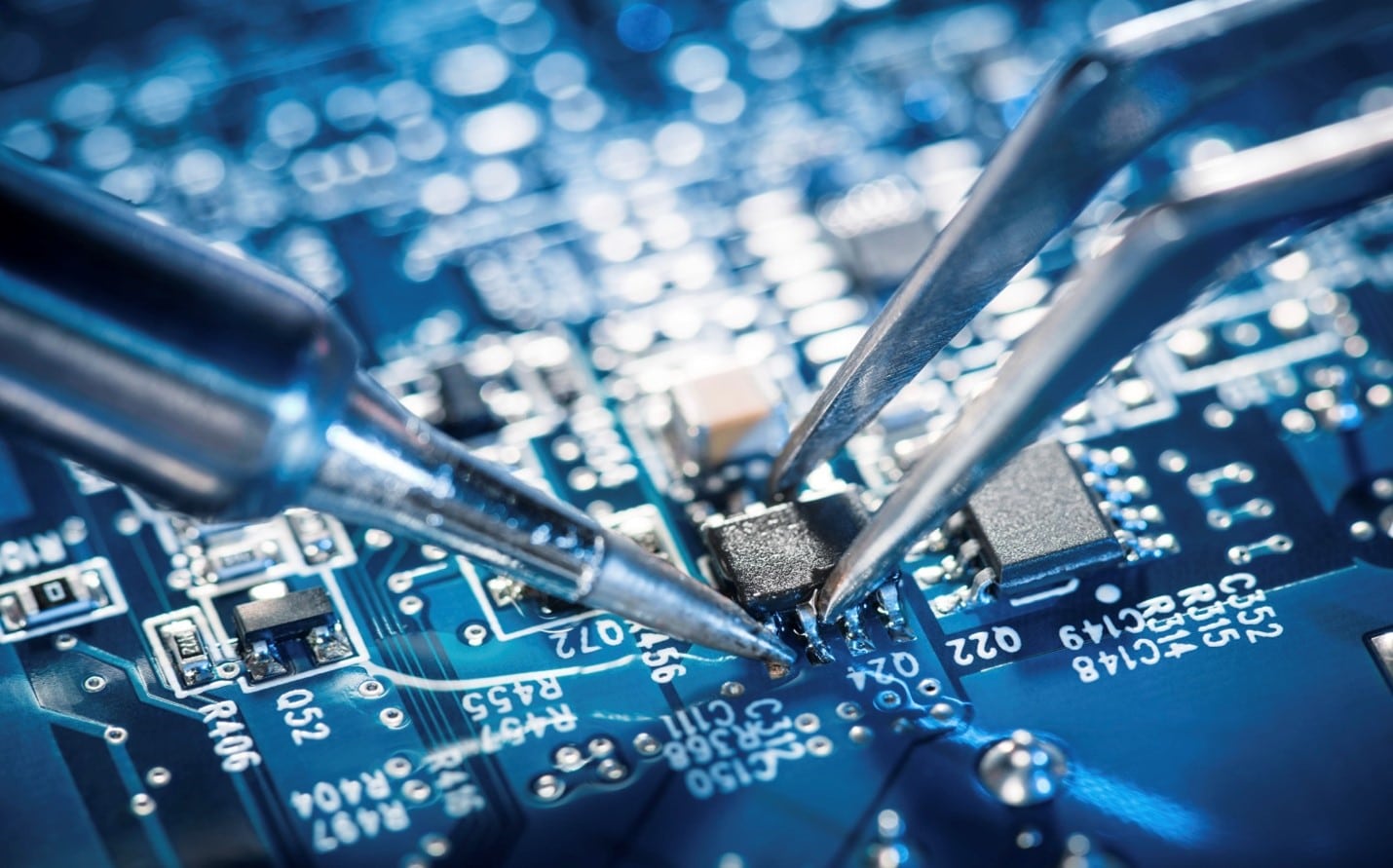

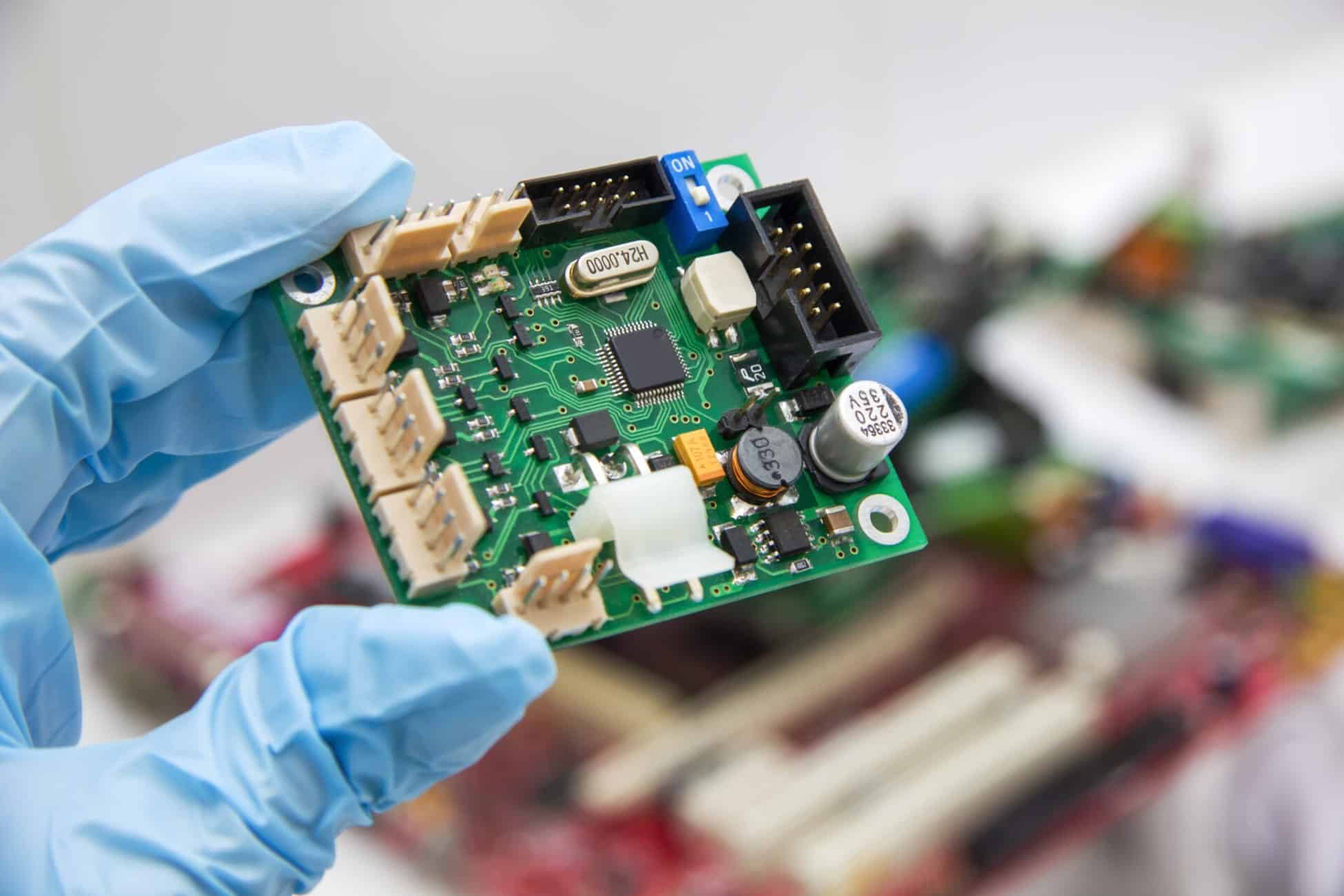

Calder is assisting an industry-leading strategic buyer to acquire an Electronics Manufacturing Services (EMS) company, with a focus on companies that produce printed circuit board assemblies (PCBAs).

Our client desires to build on their existing strength in the automotive space and diversify into adjacent end markets such as defense or aerospace.

Ideally, the target company generates under $50M in revenue and is located in the Midwest, Kentucky, West Virginia, or Pennsylvania.

Acquisition Criteria:

Target: Electronics Manufacturing Services company with a focus on PCBAs.

Geography: Minnesota, Iowa, Missouri, Wisconsin, Illinois, Indiana, Michigan, Ohio, Kentucky, West Virginia, or Pennsylvania.

Revenue: Up to $50M.

About Our Client:

With nearly 50 years of leadership in the automotive product space, our client is a leading supplier of vehicle access systems. They specialize in being a full-service supplier to the global automotive OEM base, demonstrating extensive history in R&D leading to production programs that have industry-leading end customer satisfaction and warranty scores. They have a wide range of capabilities from body color paint, mechanical crash design expertise, electronics development, and more. The client is building plans to utilize these areas of expertise outside of the automotive market space as well. Built on a legacy of innovation and adaptability, our buyer is positioned to drive growth and transformation within the acquired company.

Committed to sustainable growth, our client seeks opportunities that align with their core values and operations. With a strong emphasis on innovation, quality, and employee recognition, they have been awarded as one of America’s Best Midsize Employers by Forbes.

If you are interested or know of a potentially interested party, please fill out the confidentially connect form or contact:

Hannah Nabhan

Direct: 219-841-2064

[email protected]