Calder is working with an individual buyer to identify an industrial manufacturing, distribution, or service company for acquisition.

The ideal company generates more than $8M in revenue and is located in the greater Minneapolis metro or surrounding regional markets.

Acquisition Criteria:

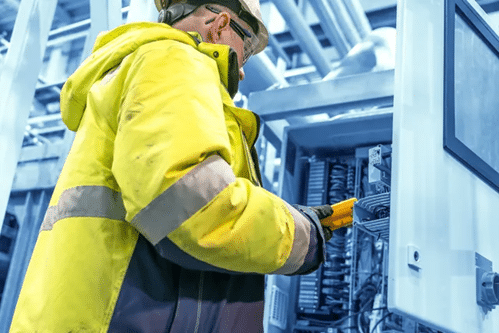

Target: Industrial manufacturing, distribution, or service.

Geography: Minneapolis–St. Paul metro, broader Minnesota, and western Wisconsin.

Revenue: $8M+.

About Our Client:

Our buyer brings nearly 20 years of executive experience and hands-on technical expertise across engineering, manufacturing, and sales operations within a major industrial corporation. He has led teams ranging from front-line operators to cross-functional professionals. A seasoned leader, he has a proven track record of scaling businesses and solving complex challenges. He has successfully led business units through various stages of growth–including mature and turnaround situations–by implementing lean and sustainable production processes, creating and implementing sales function overhauls, and executing long-term growth plans developed with his teams.

Our buyer will personally lead the acquired company with integrity, accountability, and a passion for continuous improvement. Guided by an employee-first and growth-oriented mindset, he is committed to empowering employees to unlock their potential and drive performance. He brings a unique balance of hands-on operational discipline and long-term strategic vision.

If you are interested or know of a potentially interested party, please fill out the confidential connect form or contact:

Francesco Pizzo

Direct: 586-802-9666

[email protected]