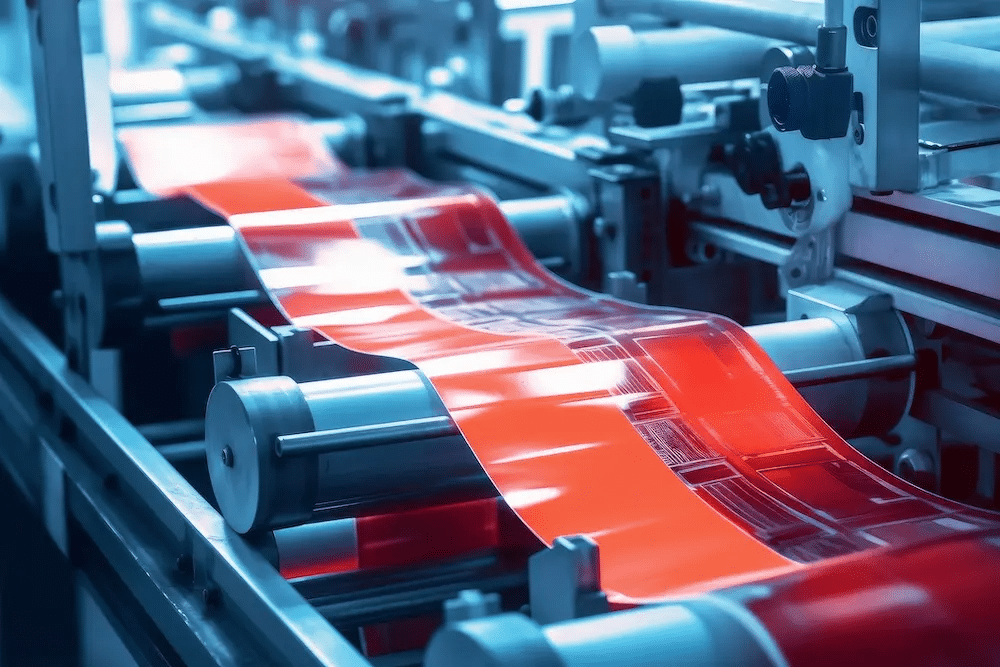

Calder is assisting a family office buyer seeking a manufacturing or service-based company to acquire. Our client is particularly interested in manufacturers across a wide range of industries from food & beverage products to printing & packaging to automotive and hardware parts, or business services companies including but not limited to wastewater management, testing, restoration, and repair.

Ideally, the target company is generating $5M-$100M in revenue, is cash-flow positive, and is located in Colorado.

Acquisition Criteria:

Target: Manufacturer of physical products or provider of business services.

Geography: Colorado.

Revenue: $5M – $100M; cash flow positive.

About Our Client:

Our client is a Denver-based family office of strategic operators with over five decades of leadership experience across diverse industries. They provide both capital and hands-on management, focusing on control investments with a long-term growth strategy. With deep operational expertise and a history of successfully scaling businesses, they are committed to sustainable value creation.

Our buyer leverages Fortune 500 resources—including management expertise, an extensive network, and strong governance—to support the growth and success of acquired businesses. Their investment philosophy prioritizes operational reinvestment, team development, and long-term value creation for employees, customers, and stakeholders.

Dedicated to preserving the legacy of acquired companies, our buyer values the history and foundation that make each business unique. By enhancing core strengths and fostering sustainable growth, they position companies for long-term success while maintaining their original vision and purpose.

If you are interested or know of a potentially interested party, please fill out the confidentially connect form or contact:

Logan Granger

Direct: 616-485-4578

[email protected]