With the successful sale of a profile laminating business during the first week of October 2022, the Calder Capital/SBDA team completed transaction #35 for 2022 and continued to accelerate rapidly towards crushing 2021’s closings and revenue by a potentially wide margin. This is despite global M&A deal volume declining 34% through the first three quarters of 2022 vs 2021.

“The tone of 2022 has not been a pleasant one and we have had to turn up the grind,” noted Max Friar, Calder’s Managing Partner. “The headlines and macroeconomic picture have continued to be dark clouds following us all year. Fortunately, there is nothing that we can do about that. What we can impact is our team, and our focus on executing in a steady, disciplined, and determined way. This is what we have been doing all year. In 2022, we have renewed our focus on approaching prospects, clients, buyers, and sellers and being very direct and honest with them about what to expect should they embark on a purchase or divestiture.”

Friar continued, “The buyer pool has thinned, weeding out many non-serious buyers, and sellers are more understanding that perhaps the best time to sell has passed for a bit. Being grounded in reality is a positive development and is helping to make deals happen. We are consistently delivering multiple offers and multiple buyers to every seller that we work with. Likewise, on the buy-side, we are consistently finding solid sellers at fair prices for our buy-side clients.”

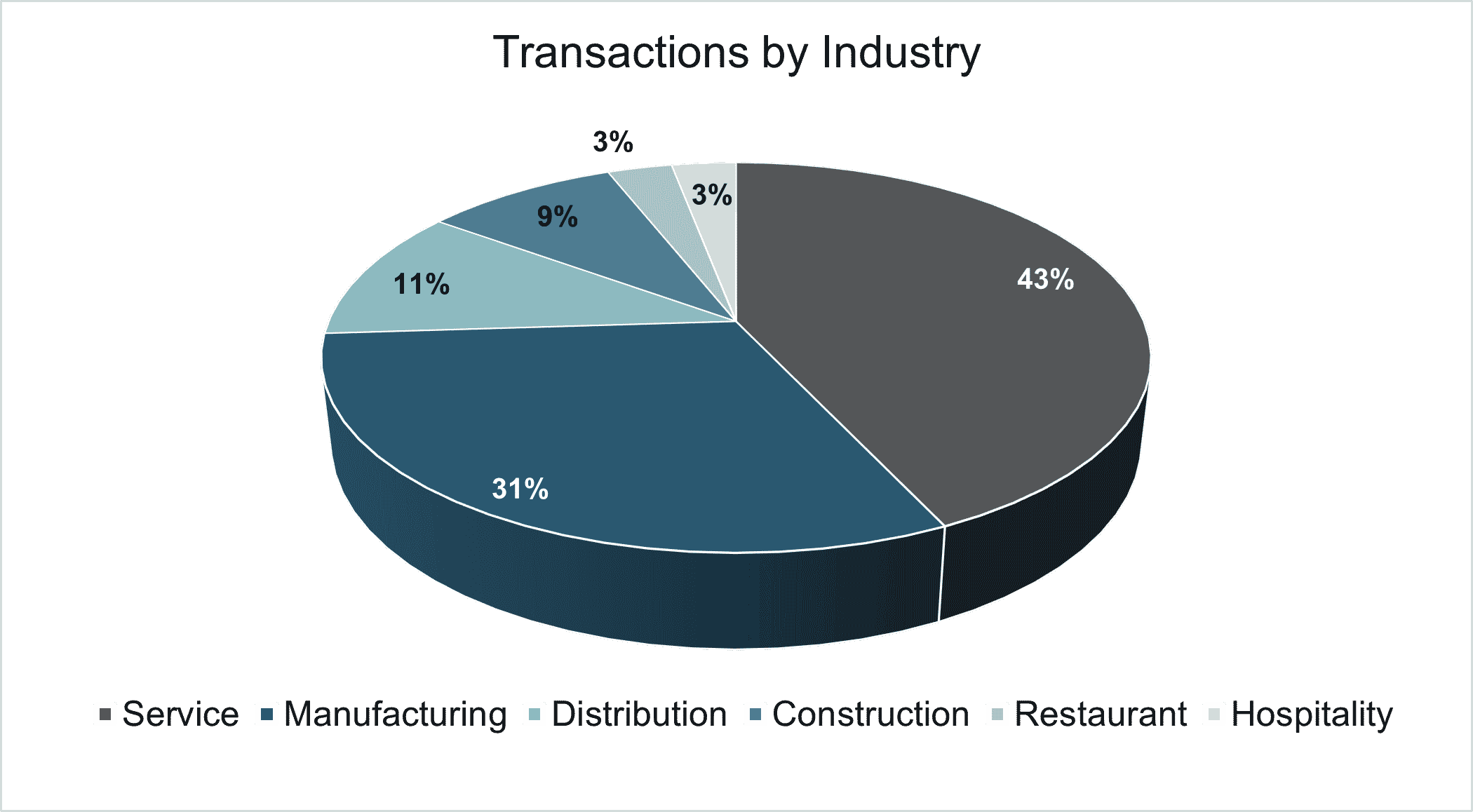

In terms of the types of transactions that are getting done by Calder/SBDA in 2022, service (43%) and manufacturing (31%) transactions lead the way, distribution and construction are the middles of the pack, and sales or restaurants/retail/hospitality are significantly lower than past years.

Comparing 2021 to 2022, we are seeing many more manufacturing opportunities resurface while business services continue to perform very well.

Here is a complete list of Calder/SBDA closings through October 3, 2022.

| Company | Location | Industry | Advisor |

| MKR Fabricators | Saginaw, MI | Manufacturing | Calder |

| Reed City Glass | Reed City, MI | Construction | SBDA |

| Colonial Car Wash | Farmington, MI | Service | Calder |

| Lamphear Service Company | Wyoming, MI | Construction | Calder |

| Oh So Clean | Grand Rapids, MI | Service | SBDA |

| Bold Socks | Grand Rapids, MI | Ecommerce | SBDA |

| Hudsonville Grille | Hudsonville, MI | Restaurant | SBDA |

| Maid Brigade | Atlanta, GA | Service | SBDA |

| J Mark Systems Inc | Grand Rapids, MI | Manufacturing | Calder |

| Premier Industries | Monroe, MI | Manufacturing | Calder |

| College HUNKS Hauling Junk | Des Moines, IA | Service | SBDA |

| Aggressive Cleaning Service, LLC | Wyoming, MI | Service | Calder |

| Diverse Global Corporation | Saugatuck, MI | Manufacturing | Calder |

| Tustin’s Asphalt Sealing | Plainwell, MI | Service | Calder |

| Amor Sign | Manistee, MI | Service | SBDA |

| Century Cleaning | Grand Rapids, MI | Service | SBDA |

| Stoney Creek Freight | Rochester Hills, MI | Service | Calder |

| Bridge Tool & Die | Buckley, MI | Manufacturing | Calder |

| Lewiston Hotel, Bar & Grill | Lewiston, MI | Hospitality | SBDA |

| Husky Precision Machining | Roseville, MI | Manufacturing | Calder |

| Kellermeier Plumbing | Rockford, MI | Service | Calder |

| Purcell Staffing | Louisville, KY | Service | SBDA |

| Aaseby Industrial Machining | Wahpeton, ND | Manufacturing | Calder |

| North Huron Storage | Ypsilanti, MI | Service | Calder |

| The Shade Shop | Grand Rapids, MI | Service | SBDA |

| Synergy Cleaning | Peoria, IL | Service | SBDA |

| RG Medical | Wixom, MI | Distribution | Calder |

| Clark Engineering | Owosso, MI | Manufacturing | Calder |

| Frank Gill | Lansing, IL | Distribution | Calder |

| Northern Office Equipment | Traverse City, MI | Distribution/Service | SBDA |

| Custom Replacement Coils | Southfield, MI | Manufacturing | SBDA |

| Prestige Building Service | Grand Haven, MI | Service | SBDA |

| Allied Bindery | Madison Heights, MI | Manufacturing | Calder |

| IBID Electric | Benton Harbor, MI | Construction | Calder |

| Profile Laminator | Midwest | Manufacturing | Calder |

More granularly from an industry standpoint, the breakdown of deals has been as follows:

29 transactions have been in Michigan, two in Illinois, and one each in the following states: Georgia, Iowa, Kentucky, and North Dakota.

Friar concluded, “Owners continue to feel burned out by the doom cycle in the news, the inability to recruit the employees that they need, and the lingering supply chain and energy impacts of COVID and the Ukraine war. Many owners wished that they had sold in 2021 or 2022 already, however, many are also thinking that they may as well sell now before things turn potentially uglier.”

“At Calder, we are firing on all cylinders. Revenue is up 45% versus 2021. Our sales team is performing exceptionally well, signing on new clients at a rapid pace, which will result in more closed deals into Q1 and Q2 2023. We have spent the entire year becoming more and more disciplined about tracking our sales targets. Additionally, we have continued to invest in our team.

About Calder Capital, LLC

Founded in 2013 by Max Friar, Calder Capital, LLC is a lower middle-market M&A Advisory Firm focused on representing buyers and sellers with enterprise value from $1-250MM primarily in the segments of manufacturing, business services, and distribution. Calder represents sellers primarily in the Midwest and buyers nationwide.

About Small Business Deal Advisors, LLC

Founded in 2017 by Max Friar and Matthew Baas, Small Business Deal Advisors, LLC is a business intermediary firm focused on serving small, traditionally underserved sellers of businesses with enterprise value generally less than $1MM. SBDA’s clients are customarily franchised re-sales, light industrial, restaurants, and business and personal services. SBDA represents sellers nationwide and in Canada.

If you are interested in selling your company, please contact us confidentially.