With three successful closings on December 31, 2024, Calder Capital and SBDA surpassed previous annual revenue records by completing their 46th transaction of the year. This milestone marked another significant achievement for the firm, further solidifying its position as a leader in the M&A sector.

“I’m incredibly proud of our team’s dedication and hard work,” said Max Friar, Managing Partner of Calder Capital. “The amount of effort we’ve invested in aligning our growing team and hiring at a rapid pace has been extraordinary.”

Reflecting on the year’s challenges and opportunities, Friar commented, “While uncertainty is ever-present in our industry, I’m optimistic about 2025. A lower rate environment and the absence of a major election looming should allow M&A markets to function more efficiently.”

Sell-Side Reflection

Starting 2024, Calder had 61 sell-side clients. As we transition into 2025, that number is 51, following a record-breaking year of sell-side closings combined with many prospective sellers remaining on the sidelines. The sell-side team, along with many prospects and clients, faced notable challenges throughout the year:

- Lower Middle Market Softness: While the stock market performed robustly, many lower Middle Market and Main Street companies, particularly in industrial and manufacturing sectors, struggled with valuations that reflected asset value rather than earnings due to weakened performance. It was not always a matter of businesses losing money or significantly underperforming, but rather decreased demand from the highs of 2022 and 2023 combined with persistently higher costs. This created an environment where sellers faced difficult conversations about the true value of their businesses.

- Distress Cases: We observed a rise in distressed businesses contacting us in crisis mode, a sharp contrast to prior years. This phenomenon reminded us of Hemingway’s answer to the question "How did you go bankrupt?": “gradually, then suddenly.” Problems that built slowly over time when money was cheaper and post-COVID demand was stronger reached a tipping point in 2024, forcing many owners to face reality. While not an alarming trend, it was more prevalent than in the past five years.

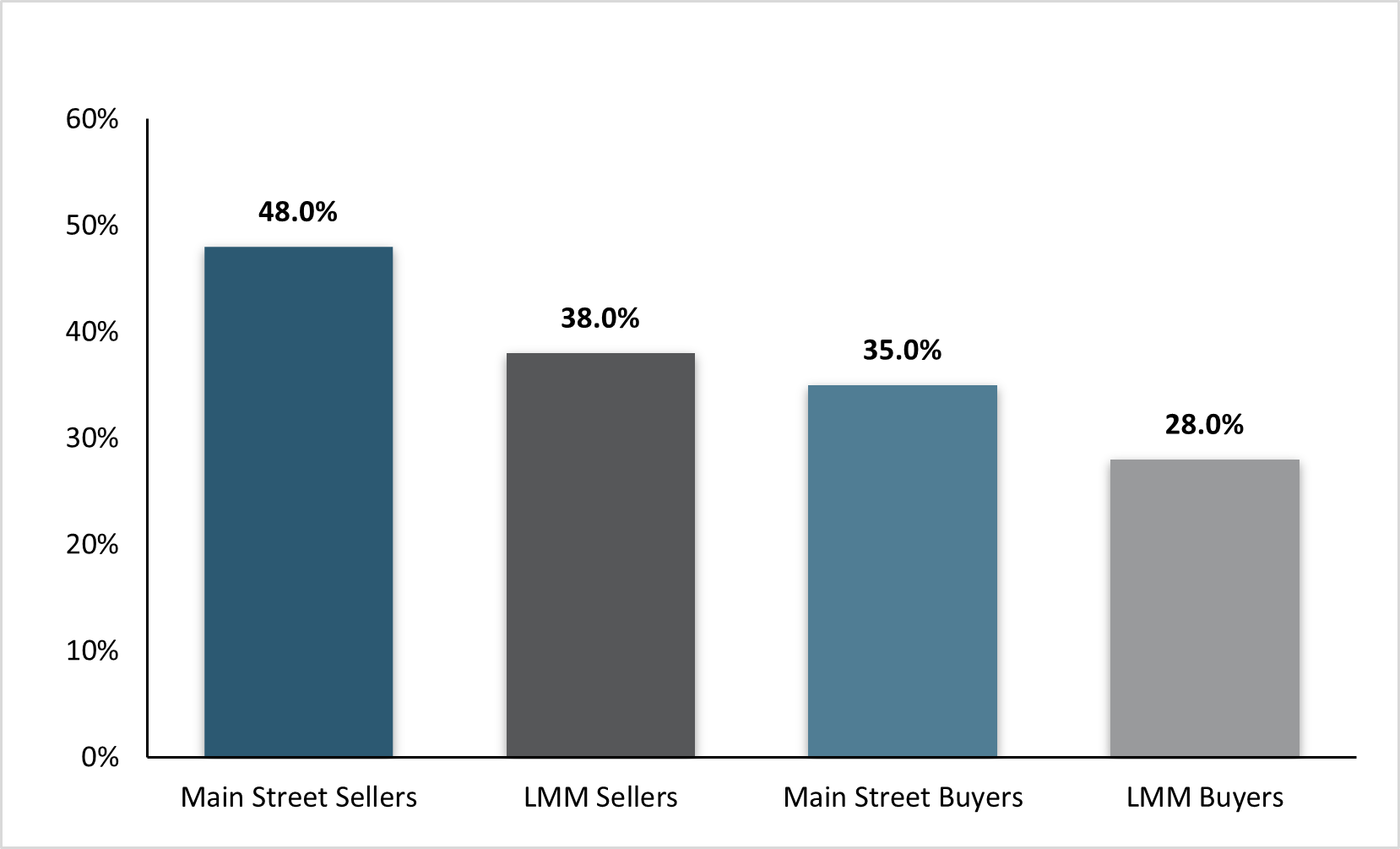

- Indecisiveness: Both sellers and buyers displayed hesitancy, often citing the November election as a key reason for delaying decisions. Surveys revealed that 38-48% of potential sellers and 28-35% of buyers opted to wait until post-election. This pause in activity underscores the significant role political uncertainties played in the market.

Looking ahead, we anticipate a slow start for new sellers entering the market in early 2025 due to:

- Optimism regarding potential tax and business policy shifts under the new administration.

- Sellers delaying decisions until after completing their 2024 tax returns and Q1 vacation plans.

- Lingering uncertainty around tariffs and immigration policies.

Despite these challenges, for companies that performed well in 2024, the market remained squarely in their favor. Should tariffs and immigration policy be only mildly impactful, rates continue to come down, and economic growth robust, more Main Street and LMM sellers will absolutely enter the market, perhaps even en masse. My gut says the market will not experience this until the 2nd half of 2025. Until then, it will remain squarely a sellers’ market for those companies that have continued to perform well.

Buy-Side Reflection

Calder’s buy-side services experienced remarkable growth in 2024, with buy-side clients increasing from 23 at the end of 2023 to 41 by year-end 2024. This growth is a testament to the shifting dynamics of the market and the strategic value Calder brings to buyers:

- Increased Demand: More well-capitalized buyers are chasing a smaller pool of high-quality sellers. This competition has created frustration among buyers, many of whom have grown weary of losing deals to competitors willing to overpromise or overpay.

- Exclusive Opportunities: Our buy-side team’s ability to uncover off-market sellers—owners preferring confidential negotiations with a single buyer—has resonated strongly with clients seeking alternatives to traditional deal-making routes.

Recognizing these needs, Calder’s buy-side team made significant investments in people and processes to ensure we can deliver significant off-market opportunities for our clients. This foundation positions us for a record-breaking year in 2025.

Calder's Strategic Growth in 2024

Calder Capital's growth in 2024 was driven by strategic hires and territory expansions across key divisions, ensuring the foundation for continued success:

Buy-Side Growth:

- Logan Theodorou, Alex Flechsig, Dominik Bepristis, Cade Peterson, and Logan Granger joined as Buy-Side Associates, strengthening Calder’s capacity to deliver exceptional off-market acquisition opportunities for clients.

- Ben Sundquist was appointed Buy-Side Search Director, bringing leadership and expertise to the critical function of Buy-Side business development.

- Jim Oren joined as a dedicated Buy-Side M&A Advisor, contributing extensive experience to the firm’s advisory capabilities.

Sell-Side Expansion:

- Greg Weess joined as a Sell-Side Associate to expand Calder’s deal execution capabilities.

- Former Analyst Jonathan Dykstra was promoted to Sell-Side Associate, reflecting his proven performance and commitment to client success.

Advisor Additions & Expansion:

- Garrett Monroe, while still serving in an M&A Advisory role, was promoted to Sell-Side Director.

- Jake McDonald was promoted to M&A Advisor and joined Calder’s Chicago team, enhancing its presence in the Midwest.

- Jakob Simonds was promoted to M&A Advisor and spearheaded the establishment of Calder’s Nashville office.

- Seasoned Advisor Matt Uhl led the opening of Calder’s Fort Myers, Florida office, catalyzing growth in the region.

- Steve Wilcox took the helm of Calder’s Lansing, Michigan office to extend the firm’s reach in the state.

- Brad Wallace joined Calder to open a new office in Dallas, Texas, solidifying its presence in the southern U.S.

Exit Planning Division Launch

- Jared Friar, CEPA joined to lead Calder’s newly-formed Exit Planning Advisory division, focusing on tailored strategies around crucial conversations, people, financial clarity, and sales systems for clients preparing for transactions.

- Early results are proving the dynamic approach to Calder’s Exit Planning is working. Two engagements were only 3 months long before the clients were ready to move forward to sell, while one engagement is 8 months and still going in 2025 as larger tasks are worked through. The key takeaway - there is no “one size fits all” approach to preparing to sell your business

- 75% of Exit Planning clients in 2024 also had a Business Valuation completed by Calder, emphasizing both the quality of the product and the importance of understanding your business’s value before considering a sale.

- One consistent piece of feedback from every client that has signed on for Exit Planning - they see the value in having a singular advisor operate as a quarterback for their advisory team. A CEPA can be viewed as a temporary board member, offering holistic, unbiased perspective on your business while helping synthesize inputs from your CPA, wealth advisor, attorney, and other key advisors.

- Calder Capital now boasts 5 advisors with the CEPA credential heading into 2025, strengthening Calder’s position as a premier Mergers & Acquisitions firm.

Specialized Divisions and Support:

- Mallory Pohl joined as Office Administrator.

- Mya Stone, SHRM-SCP joined as Director of HR to help professionalize Calder’s recruiting and retention efforts. As well as building our internal capabilities, Mya heads our Human Capital Consulting.

Awards and Recognitions:

- Calder Capital ranked No. 1,409 on the 2024 Inc. 5000 list, marking its third appearance and reflecting a 346% growth since 2020. This is an achievement that less than 10% of Inc. 5000 recipients achieve.

- For the second consecutive year, Calder was named Best Business Investment Firm in the Best of Michiana Business Awards.

- The firm received a Bronze Stevie® Award in the Financial Services Company of the Year category for medium-sized businesses, acknowledging its exceptional performance in the financial services sector.

- For the second consecutive year, Calder Capital was honored as a National Best and Brightest Company to Work For, highlighting its innovative business practices and commitment to employee enrichment.

- Inc. 5000 Regionals Midwest Award: Calder secured the No. 73 spot in the Midwest region, further emphasizing its rapid growth and regional impact.

- Calder Advisor Pankaj Rajadhyaksha was recognized for Retail Deal of the Year at Crain’s M&A Awards.

- Best in Biz Awards: Calder Capital earned a Gold award in the Business Development Department of the Year category and a Silver award in the Sales Department of the Year category, recognizing its excellence in business and sales development.

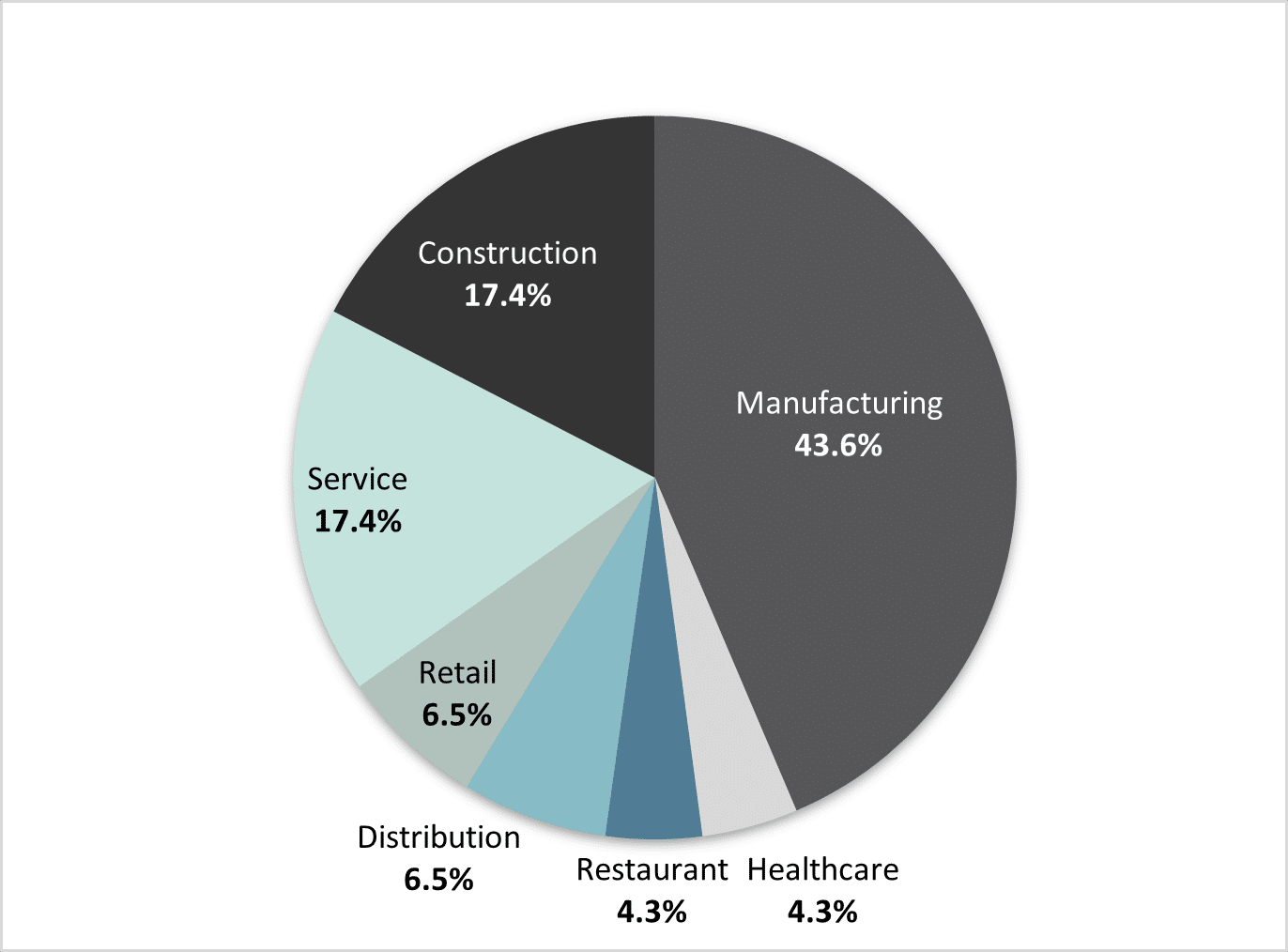

Transactions by Industry in 2024

Calder is a generalist M&A firm with a focus on manufacturing, construction, service, and distribution transactions in the $1-100M EV space.

In 2024, Manufacturing emerged as the dominant sector for our deals, representing a significant portion (43.5%) of our transactions. This result underscores our strong alignment with industries that continue to drive economic activity and investment interest in the Midwest, as well as our ability to recruit buyers into this space, including entrepreneurs, financial buyers, and strategic buyers.

The Service industry also accounted for a substantial share of transactions, highlighting the continued demand for businesses offering essential and professional services. Construction, while slightly smaller in proportion, remained a key contributor, consistent with ongoing infrastructure development and related investments.

Notably, Healthcare appeared as a new sector in 2024, indicating successful entry into this high-growth and increasingly essential industry. While Retail maintained a presence, its representation was modest, reflecting headwinds. Additionally, Distribution and Restaurant transactions provided further diversification, demonstrating our adaptability to serve various industries.

Overall, the 2024 results reflect a strategic focus on high-demand sectors while maintaining a balanced portfolio of transactions. These outcomes position us well to capitalize on market trends and continue delivering value to our clients in 2025.

2024 Closings

Here is a complete list of Calder/SBDA closings through December 31, 2024.

| Number | Company | Location | Industry |

| 1 | Lloyd’s Cabinet Shop, Inc. | Pinconning, MI | Manufacturing |

| 2 | Lakeland Mills | Edmore, MI | Manufacturing |

| 3 | Established General Contractor | Midland, MI | Construction |

| 4 | Primo Hoagies | Edwardsville, PA | Food Service |

| 5 | Bear Stewart Corporation (Buy-Side) | Chicago, IL | Manufacturing |

| 6 | Machine Shop | South Bend, IN | Manufacturing |

| 7 | Once Upon a Child | Clarksville, TN | Distribution |

| 8 | Rehabilitation Health Center | Ann Arbor, MI | Healthcare |

| 9 | American Gear & Tech Tool | Westland, MI | Manufacturing |

| 10 | Automotive Metal Manufacturer (Buy-Side) | Portland, MI | Manufacturing |

| 11 | Cookies by Design | Grandville, MI | Food Service |

| 12 | Thread-Craft, Inc. | Sterling Heights, MI | Manufacturing |

| 13 | Brandworks Detroit | Ann Arbor, MI | Service |

| 14 | OJS Building Services, Inc. | Mishawaka, IN | Construction |

| 15 | Flooring Retailer | MI | Distribution |

| 16 | HSV Redi- Mix | Lake Odessa, MI | Distribution |

| 17 | Access Companies | Saginaw, MI | Distribution |

| 18 | Food Service Distributor | Midwest | Distribution |

| 19 | Allied Electric | Walker, MI | Construction |

| 20 | Hi-Tec Building Services | Jenison, MI | Service |

| 21 | Envision Engineering | Lowell, MI | Manufacturing |

| 22 | H A Campbell | Grand Rapids, MI | Distribution |

| 23 | Agricultural Service | IA | Service |

| 24 | Phillips Lifestyles | Grawn, MI | Distribution |

| 25 | Champagne & Marx | Saginaw, MI | Construction |

| 26 | Tri-Form, Inc. | Pittsburgh, PA | Manufacturing |

| 27 | Courtesy Driving School | Shelby Twp, MI | Service |

| 28 | Machine Shop | MI | Manufacturing |

| 29 | Wolverine Lawn | Kalamazoo, MI | Service |

| 30 | Waterproofing & Repair Business | IN | Service |

| 31 | Drafting & Engineering Services Business | MI | Manufacturing |

| 32 | Sports Bar & Grill | MI | Food Service |

| 33 | Floorguard Products (Buy-Side) | Chicago, IL | Construction |

| 34 | Sales & Project Management Construction Company | Chicago, IL | Construction |

| 35 | Niche Manufacturer | MI | Manufacturing |

| 36 | Furniture Manufacturer | MI | Manufacturing |

| 37 | Glazing Contractor | Hillside, IL | Construction |

| 38 | David Arthur Consultants | Dundee, MI | Service |

| 39 | Great Lakes Window Products | Holland, MI | Distribution |

| 40 | Siding Construction Company | Holland, MI | Construction |

| 41 | Capital Stoneworks | Bridgeport, MI | Distribution |

| 42 | AG Manufacturer (Buy-Side) | MN | Manufacturing |

| 43 | Party Tent & Rental Services Company | Traverse City, MI | Service |

| 44 | Master Precision Mold | Greenville, MI | Manufacturing |

| 45 | Tigmaster Co. | Baroda, MI | Manufacturing |

| 46 | Landscape Design & Maintenance Company | Kalamazoo, MI | Service |

Beyond a diversity of industries, Calder/SBDA continues to expand its geographic reach, closing transactions in 2024 in 7 states.

As we enter 2025, Calder is positioned for another year of growth. With investments in geographic expansion, team members, company alignment and values, and the continued strengthening of partnerships, we are ready to meet the needs of an evolving market. Our team’s resilience and innovation will ensure we capitalize on opportunity, delivering exceptional outcomes for our clients.

About Calder Capital

Founded in 2013, Calder Capital, LLC is a lower middle market investment bank providing mergers and acquisitions advisory services to business owners, entrepreneurs, family offices, and investors across the United States. Our dedicated team of professionals combines extensive industry experience, technological innovation, negotiation savvy, and key relationships to exhibit exceptional execution. Calder’s services include mergers and acquisitions advisory, private funds and capital markets advisory, and business valuations.