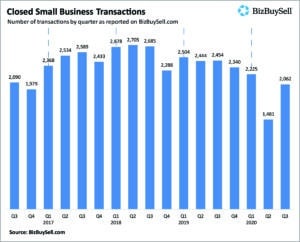

We all know what a bizarre year it’s been; and let’s face it, it’s not over yet. BizBuySell recently published its periodic Insight Report, which only further illuminates uncertainty and mixed feelings.

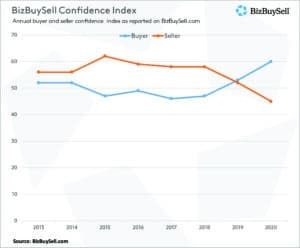

BizBuySell’s Small Business Confidence Survey

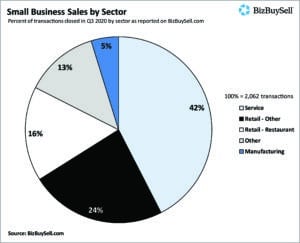

It seems that buyer confidence is relatively high, while seller confidence is relatively low, in 2020. This is a trend we’ve definitely seen at Calder Capital–demand for business acquisitions is up, and supply is down. In fact, Calder has experienced a record year due in part to strong buyer demand for our opportunities. A lot of business owners are regretting not having exited their business in 2019, but couldn’t have anticipated feeling this way at the time.

Although, perhaps a lot of sellers would feel differently if they realized that the demand was up, giving them a bit more control over valuation than they might foresee.

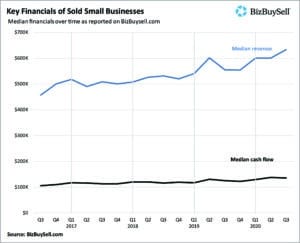

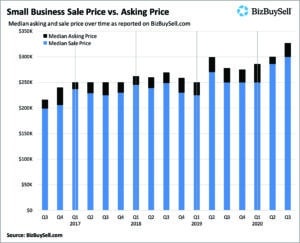

Median Sale Prices Significantly Increased

The increase in demand is particularly noticeable when it comes to pandemic-proof businesses. Here’s an investment highlight we couldn’t have anticipated in 2019; and yet, whether we consider something essential in times of economic shutdown has become make or break.

‘ “Any business making money during this crisis is golden,” says John Davanzo, owner of Animal Atlanta in Georgia. These business owners are faced with a good-to-have, yet difficult decision on whether to cash in on the favorable situation or hold tight for even higher value. The decision becomes even more complicated for those specifically thriving because of the pandemic but with risk of losing value when the pandemic ends.’

Of course, for nonessential businesses, the market hasn’t seemed so “golden.” While there doesn’t seem to be much panic even amongst these business owners, there’s a trend of hunkering down and hoping for valuations to go up once things bounce back to normal, whatever that is.

Increased Popularity of Asset Sales

For Restaurant owners, an Asset Sale is often the best exit strategy in the current market. Gyms, hair salons, and other non-essentials which also come with high risk for spreading COVID-19 are in the same boat, as they don’t even have the option of being open for take-out only, as restaurants do.

But there are limited buyers for asset sales, because not every buyer has the capital to invest in the assets up front and then wait to open shop back up once there’s more potential for revenue. These purchases can be high risk; unfortunately, a lot of these types of businesses will end up closing down before a buyer can be found.

Baby Boomers Waiting it Out

Baby Boomers who are relying on the income from selling their business have limited options. Sell now and take the hit, or stick it out and until things go back to normal; but the latter will involve a long wait, because it’ll be awhile before valuations go back to what they were pre COVID-19.

Election Concerns Further Complicate Potential Outcomes

Maybe we say it every four years, but the stakes are particularly high for the pending presidential election. However, even amongst business owners, there are mixed sentiments on which party would most benefit business owners when they take office. So, how high are they?

On top of that, many business owners are experiencing no small amount of anxiety over repaying their PPP loan if it isn’t forgiven, and this uncertainty is compelling some business owners to hold off on selling until they know for sure what they’re in for.

Small Business Owners Eagerly Await a Return to Normalcy

A return to economic normalcy is hoped for across the board, it seems. The biggest discrepancy in opinion seems to come from conjecturing the timeline.

‘As America awaits political and economic clarity, most owners (75%) are anticipating a full return to pre-pandemic levels to occur in the next 2 years, with half expecting a recovery within the next 12 months. Buyer timelines lean slightly longer at 70% and 32% respectively. According to Apolinario, however, each day brings new optimism for the business-for-sale market.’

A lot of transactions are being put on hold, if not for a return to normalcy, then for a conclusive answer as to who will occupy the oval office come 2021.

The BizBuySell Insight Report is a nationally-recognized economic indicator that tracks the health of the U.S. small business economy. To read the full report, click here.