While 2019 was filled with uncertainty and lots of questions surrounding what would result of the trade war, 2020 shows signs of continuing the largest U.S. economic expansion in history and lower middle market mergers & acquisitions activity is expected to remain elevated.

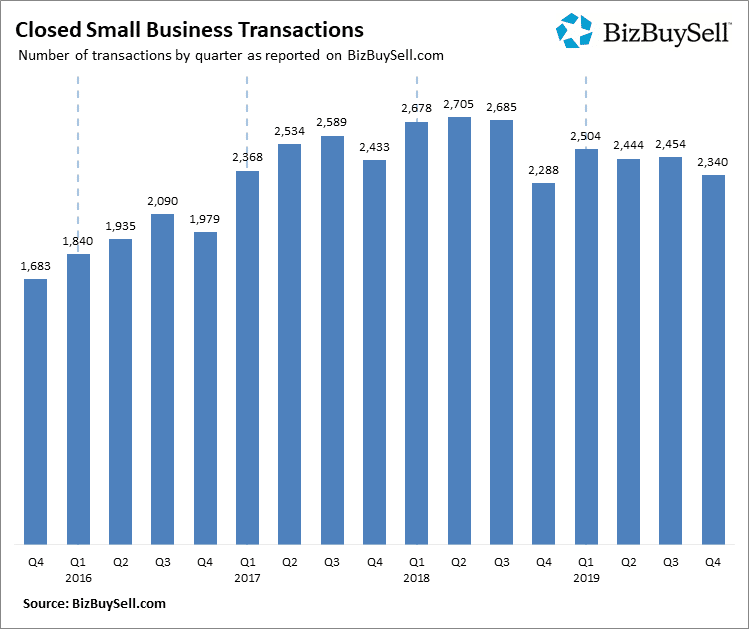

Reflecting on 2019, Bizbuysell.com’s recent Insight Report stated: “What is certain is that 2019 small business financial performance thrived. The median revenue and cash flow of businesses sold in 2019 reached all-time highs, up seven percent and two percent respectively. At the same time, sale prices remained mostly flat, which would seem to favor a buyers’ market. This is supported by the 6 point increase in 2019 buyer confidence, rising while owner confidence has dipped.”

“However, taking a deeper look, the deals are more balanced than they appear. Sellers are sacrificing value to avoid an uncertain future – and at prices much higher than past years – while buyers take on increased value and risk. The result is very positive for both parties and represents a rare, terrific opportunity to exit or enter the market.”

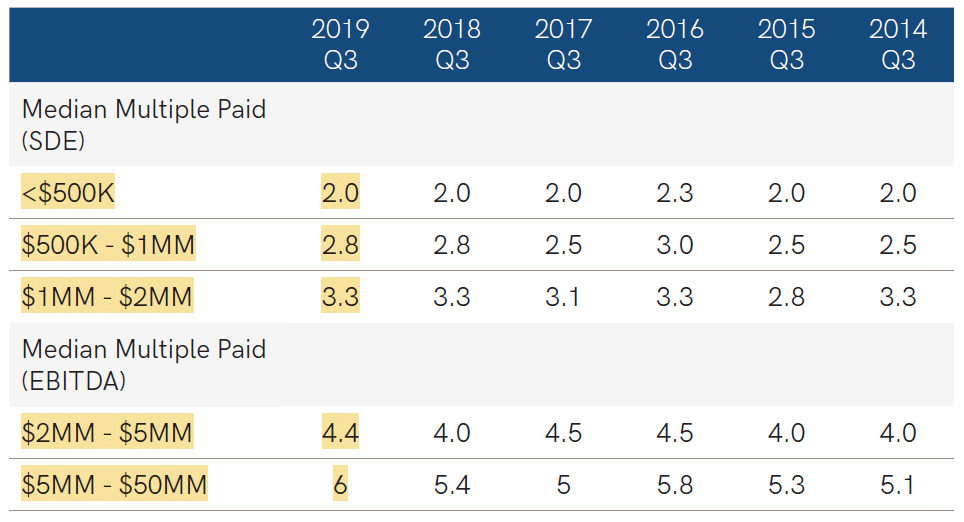

According to the latest IBBA Market Pulse report, valuations remain strong and multiples the highest since 2014, for nearly every business size. Despite lingering concerns over tariffs and the coming election, businesses continued to perform and grow, interest rates remain low and buyers remain aggressive.

According to a business broker interviewed in the recent IBBA report, “If buyers think this is the wrong time to buy, it will be a bigger threat than any other single factor. But, if buyers want to buy, there will be plenty of sellers who will be willing to sell.”

Evidence from the market indicates that buyers remain on the lookout for quality businesses, as indicated by the record number of deals closed by Calder Capital in 2019. Not only are buyers active, but they are looking to move quickly, as was the case with the recent sale of Precise CNC Routing, which from start to finish took only 4 months.

Sale multiples continue to hold in all categories, with a continued rise in multiples for transactions over $5MM.

Overall, we are very bullish about small business transactions in 2020. We agree that the market appears to be balancing out, which is likely a win for getting deals done!

What is your business worth?

As you head into 2020, are you aware of the value of your business? Business valuations are one of the most underutilized tools for business owners. Despite the common belief that the only need for a business valuation is when you are preparing to sell, there are many reasons to conduct a business valuation. It is crucial to understand the value of your business, otherwise, how can an owner know where they are from a succession-planning standpoint?

Calder Capital is offering $500 off business valuations during the month of February. Take advantage of the offer and get started on your business valuation today! Or contact Sam Scharich with questions: [email protected]. Get started today!