Buying a company is often one of the most challenging things that a person embarks on in their life. It requires a tremendous amount of thought, risk, and resources. Below, I have summarized six situations that greatly affect risk and return. It is unrealistic to purchase a perfect business so these situations should not cause you to necessarily rule out a purchase. They are common areas where discussions regarding valuation and deal structure can go awry and should be addressed sooner rather than later when in discussions with the seller (or the seller’s advisor).

Unrealistic Seller Value Expectations

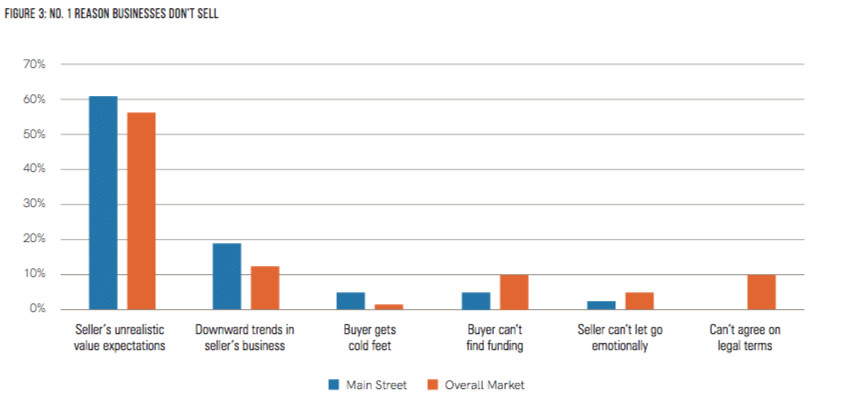

Unrealistic valuation expectation is the top deal-killer. Perhaps better put, it is the top inhibitor to even getting a negotiation started. Owners tend to overvalue their business generally because they think that it is a) unique and therefore the goodwill is supremely valuable, or b) they need a certain valuation to retire and/or pay off their debts. The issue here is that neither of these tied to the buyers’ reality. Buyers buy based on return. Even when they get emotionally attached to a business and are willing to pay a premium, their lender, attorney and CPA will likely bring things back to reality. Furthermore, while it is true that every business is unique in its own way, there are always alternative businesses to buy and generally, buyers will move on to find a more appropriately priced opportunity.

If you are interested in understanding the current market realities of business valuation, deal structure, timing, and trends, please review my summary and analysis of the most recent IBBA Market Pulse Report for Q3 2019 here. While there are exceptions, the data in this report is golden and it reflects the realities that we live daily in discussions with buyers, sellers, and lenders.

Declining Business

When sales and/or profits are declining year-over-year, buyers get very nervous and often walk away. Additionally, it becomes difficult to find a lender willing to finance the deal. In this instance, it can be common for sellers to say things like, “Well, a buyer could do so much more. There are so many opportunities to grow the business.”. While this is often true, beware of taking this comment at face value. It can often mean, “I want you to pay me more for what you are going to do with the business once you purchase it.” The expectations of owners in a declining business situation generally lag reality, often significantly.

Significant Owner Involvement

Often, owners of small businesses are working 60-70 hours/week and are deeply involved in all tasks. While this does not prevent a sale, it can cause buyers to be concerned about the risks of losing that owners’ relationships and/or tribal technical knowledge.

Prometis Partners, a local business succession planning advisor in Grand Rapids, provides this helpful Management Succession Worksheet. A beneficial exercise would be to go through this document with the owner of the target business to determine where gaps exist in terms of what tasks the owner handles. This will assist in determining the owner’s existing level of involvement.

Previously, I wrote an extensive article outlining the effects of owner dependence on the success of a business sale.

High Customer Concentration

Customer concentration (generally where there is one customer at 50%+ of sales) will not often prevent a sale but it almost universally results in the deal structure containing an earnout or contingent portion based on that customer remaining with the company for an extended period of time.

It is rare to find a seller that is ok with an earnout. This is understandable; after all, once the owner hands the keys over their ability to affect the direction of the company diminishes. However, it is also understandable that a buyer will hedge their risk. After all, if that customer leaves or goes out of business the business will soon likely be on life support.

Holly Magister of Exit Promise goes into much more detail on this issue in her article, How to Overcome Customer Concentration Objection When Selling a Business.

Deferred Capital Expenditure

As you can imagine, when an owner starts thinking about selling they can become less inclined to continue to invest in the business. This can often result in a scenario where cash flows remain strong but the equipment and facility start to fall into disrepair. Additionally, the owner might decide not to keep up with new technologies or innovations necessary to remain competitive. The result might be that from a cash flow multiple standpoint the business is consistent with the past. However, factoring in necessary investments (primarily in equipment assets), buyers are likely going to discount the valuation.

Underutilized/Excess Equipment

Particularly in cases where the economy is slowing or owners have lost their zeal for growth, we run into situations where, for example, the seller might have $2MM of machinery and equipment producing EBITDA of $300K. From an asset position, the value of the business is arguably $2MM (and often these owners will have a certified appraisal defending this case). From a market multiple position (ex. EBITDA $300K x ~3.5) the business may be valued at closer to $1MM. So, what is the value? That is a good question that is going to largely depend on the buyer. Most often, it is rare that an asset value that holds up. Why is this? The buyer is going to say, “Well, sure, there may be $2MM of equipment but those equipment assets are not producing an adequate return. Therefore, when I buy the company I am going to have to further invest in the business in order to generate an acceptable return.” There is no rule for handling this situation but often the buyers will offer some discount on the asset valuation. We generally recommend to sellers that they sell off underutilized or non-utilized equipment prior to the sale process.

In conclusion, nothing stated here is meant to deter you from buying a company. In fact, there is nothing that excites me more than entrepreneurs breaking free of the shackles of corporate life and charting their own path. And according to people much smarter than I am, owning a small business is one of the proven ways to amassing significant wealth. The intent of this article is simply to give you some real-life insight into major areas of contention when it comes to valuation and getting the deal across the finish line. As the great Stoic, Marcus Aurelius, wrote: “Our actions may be impeded, but there can be no impeding our intentions or dispositions.

About The Author – Max Friar

Max Friar is the Founder and Managing Partner of Calder Capital, LLC. Max began his tenure in mergers and acquisitions in 2005. His love of the industry is underpinned by an entrepreneurial drive and enjoyment of being a student of success. Max has been a lifelong resident of Grand Rapids, Michigan.

About Calder Capital, LLC

Calder Capital represents sellers of manufacturing, service and distribution companies with an enterprise value of $1-100MM. Our sister company, Small Business Deal Advisors, LLC, works with sellers of smaller businesses, with a focus on franchise resale opportunities.

Calder Capital is pleased to have sourced and closed ACG/Mibiz.com’s 2018 Deal of the Year <$25MM. Additionally, we are humbled that Max Friar was awarded Dealmaker of the Year Finalist 2018. Additionally, Calder received the distinction of #1 area M&A Firm by the number of closed transactions for 2019.

We are looking forward to hearing from you! Please contact Calder confidentially here.