The International Business Brokers Association Q2 2019 Market Pulse recently came out. The Market Pulse Report is one of the most insightful reports on the state of the market and includes the aggregate results of surveys conducted in July 2019 of 288 M&A Advisors. Insights include deal multiples, deal structure, types and motivation of buyers, the timing of the sale, and general commentary from advisors.

Here is the full report: IBBA Market Pulse.

Hot Industries: Construction/engineering and business services companies lead among hot industries. This is the first time construction/engineering has held such a prominent share of market activity. “Construction activity is hot right now. Companies have strong balance sheets, so they’re expanding their facilities and state and local governments are reinvesting in roads. It makes sense that construction companies are selling now and getting out while things are good,” said Lisa Riley, LINK Business-Phoenix.

Who’s Buying? Leading buyers for companies valued between $1 to 5 million have been first-time buyers and serial entrepreneurs, followed by existing companies. Leading buyers for companies valued greater than $5 million have been existing companies (54%) followed by private equity (31%). The primary motivations for the acquisitions of these size companies are gaining a horizontal add-on and buying a job.

Craig Everett, Ph.D., Pepperdine Private Capital Markets, commented, “Private equity is extremely active in the lower middle market, and that’s pushing values upward. Industry reports suggest private equity has nearly $2.5 trillion in unspent cash right now. Many of them are shifting resources down to the Lower Middle Market in order to maximize their chances of winning a deal and putting that cash to work.”

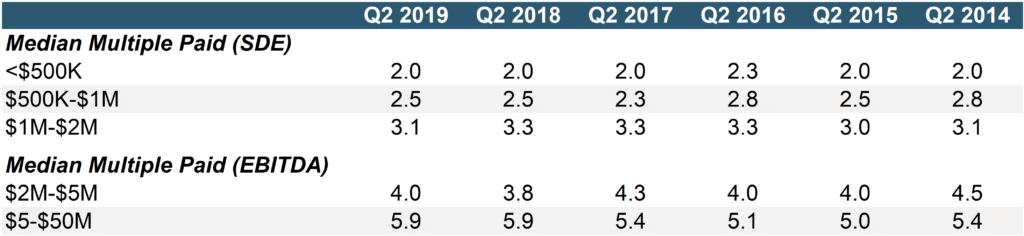

Multiples: Sale multiples continue to hold up, with the only decline in the category of businesses valued between $1 to 2 million.

SALE MULTIPLES

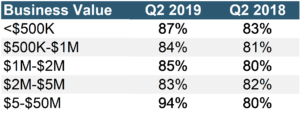

Deal Structure: Seller financing continues to remain very low, with most businesses receiving ~85% cash at closing. Businesses valued at $5MM+ received a record 94% cash at closing!

CASH AT CLOSING

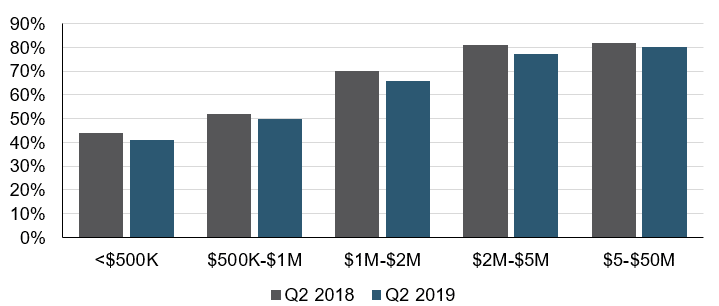

Sentiment: Sellers continue to have the advantage in market sectors above $1 million however confidence continues to drop across every sector and has for the past 3 quarters. “It’s still a strong marketplace with more buyers than sellers…but tariff issues are popping up and talk of a recession in the next 12 to 18 months is scaring some buyers away,” noted Randy Bring, Transworld Business Advisors.

SELLER’S MARKET SENTIMENT

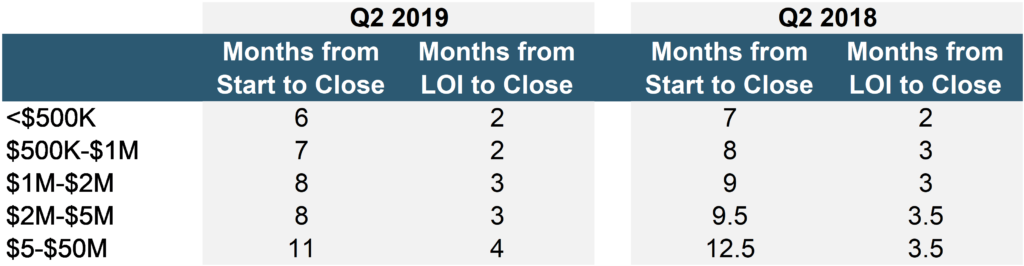

Timing: The average time to close 8 months, more than a full month decrease from last year.

TIME TO CLOSING

Transition Planning: In general, 50%+ of business owners do not meet with their attorney or CPA prior to engage to sell. Even among business owners who do plan, only a few are working with any kind of professional advisor (e.g. CPA, wealth, attorney, broker) to discuss exit strategies a year or more in advance.

The Exit Planning Institute estimates there are more than 4.5 million businesses expected to transition in the next 10 years in the US. David Ryan, Upton Financial, commented, “We could see a shift in supply-and-demand as more Boomers go to market. That could change dynamics significantly and create some real pain points for retiring Boomer business owners.”

The number one reason for selling in all business categories was retirement.