Calder Capital is pleased to announce the successful acquisition of EBW Electronics, headquartered in Holland, MI, by ADAC, based in Grand Rapids, MI.

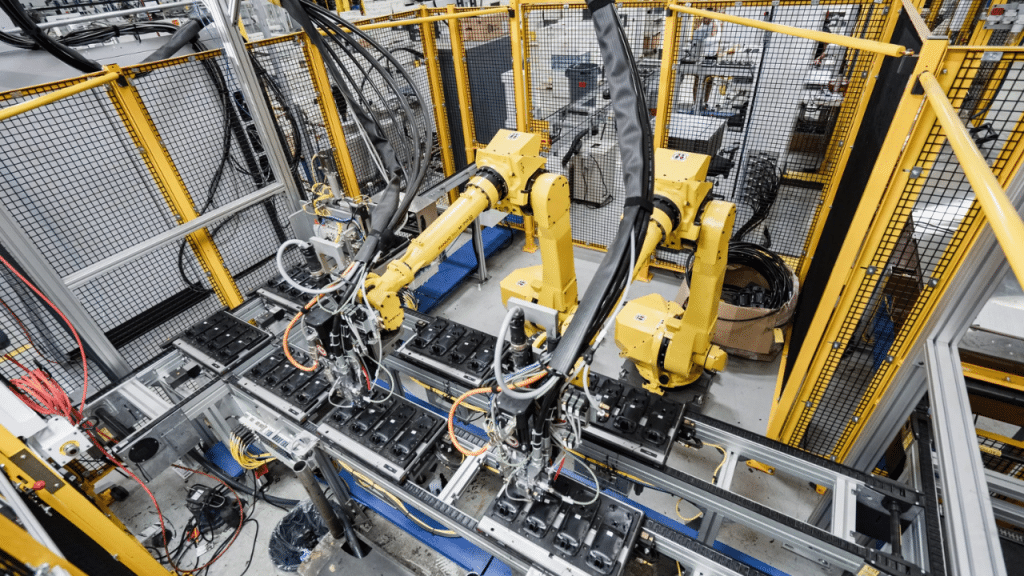

ADAC, a diversified solutions provider to the automotive, industrial, medical, marine and other industries, founded in 1975 is renowned for its development and production of vehicle access systems, sensor technologies, lighting components, integrated electronics, radar and communication solutions and more. Jennifer Williamson, Executive Vice President and Chief Financial Officer of ADAC, reached out to Calder Capital’s Buy-Side team in pursuit of strategic acquisition opportunities that would support ADAC’s innovation and end-market diversification goals.

Founded in 1992 by Leo LeBlanc, EBW Electronics began with just two employees, focused on developing an electronic monitoring system for fueling tanks. Today, the company has over 150 employees and is a global leader, specializing in electronic manufacturing solutions. Their products include performance sensors, switches, actuators, and lighting systems for a variety of sectors.

“With the incredible support and commitment from the Teets family ownership, we are excited to bring together two great family-owned companies with aligned cultures, work ethic, and innovative mindsets” commented Jon Husby, President and CEO of ADAC. “We believe this acquisition will help ADAC exceed our diversified revenue goals by doubling the size of newly acquired ADAC Electronics within four years.”

Cory Steeby, President of EBW Electronics (EBWE), has led the company through growth and expansion, emphasizing engineering innovation and a strong customer-first philosophy. “For 34 years, EBW has thrived under the LeBlanc family’s commitment to our people, our customers, and doing things the right way,” said Steeby. “Joining forces with ADAC allows us to carry that legacy forward while embracing new opportunities that honor our history and strengthen our future.”

Husby adds, “Calder Capital’s support through the entire process was invaluable and helped make this West Michigan based opportunity a reality for ADAC and the long-term vision of the Teets family.”

Patrick Robey of Calder Capital served as the lead Mergers and Acquisitions Advisor to ADAC. Over the course of the engagement, Calder facilitated 36 introductions between ADAC and prospective acquisition targets before successfully guiding the parties through a signed letter of intent and closing.

“Cory and the LeBlanc family built an outstanding company,” Patrick remarked. “EBWE was extremely intentional about finding a buyer that would continue EBWE’s legacy while bringing additional resources and scale, and throughout this process, we were deliberate in the effort to show that ADAC meets each of these goals.”

“Working with Calder Capital, and specifically with Patrick Robey, was instrumental to the success of this acquisition,” said Jon Husby, President and CEO of ADAC. “Patrick’s professionalism, responsiveness, and understanding of our strategic goals were evident from day one. The Calder team provided a steady stream of qualified opportunities and acted as trusted advisors throughout the entire process. We are grateful for their guidance in helping us secure a great cultural and technical fit in EBW Electronics.”

“We felt respected and understood when working with Patrick Robey and the Calder Capital team,” said Cory Steeby. “The sales process was smooth, and Calder Capital was both knowledgeable and professional. We are excited to be in this new partnership with ADAC.”

“We’re honored to have worked with ADAC’s leadership to help them secure an acquisition that fits well with their growth vision,” commented Max Friar, Founder and Managing Partner of Calder Capital. “We look forward to watching this partnership flourish.”

Calder Capital, LLC, served as ADAC’s Exclusive Buy-Side Mergers and Acquisitions Advisor. Tracy Larsen and Jordan Schwartz of Honigman provided legal counsel for ADAC. Rehmann provided financial due diligence advisory for the buyers, and Crowe provided Tax Due Diligence Advisory. Mark Streekstra from Charter Capital Partners served as EBW Electronics’ Mergers and Acquisitions Advisor. Bob Wolford of Miller Johnson served as legal counsel to EBW Electronics.

About EBW Electronics:

EBW Electronics, based in Holland, MI, is a global leader in LED circuit board design and electronic manufacturing. The company specializes in high-performance printed circuit board assemblies and innovative LED applications tailored for a wide range of industries. To learn more, please visit https://ebw-electronics.com.

About ADAC:

ADAC, headquartered in Grand Rapids, MI, is a leading diversified solutions provider to the automotive, industrial, medical, marine and other industries offering design, development, customization, quality control, testing and validation, prototyping, and manufacturing. To learn more, please visit https://www.adaccompanies.com.

About Calder Capital:

Calder Capital, LLC is a lower middle market investment bank providing mergers and acquisitions advisory services to business owners, entrepreneurs, family offices, and investors across the United States. Calder’s services include buy-side and sell-side advisory, business valuations, and capital sourcing. To learn more, please visit http://caldergr.com.