See what Yan Vinarskiy (Buyer) who acquired Floorguard Products had to say about working with the buy-side team to source and close the deal!

Take a listen to Calder buy-side client Will Gano's success story in the acquisition of food products manufacturer Bear Stewart Corp on the Acquiring Minds podcast.

Also, featured on the podcast, check out Calder buy-side client Peter Ciaverilla’s story acquiring an HVAC business!

2024 Economic Commentary

2024 was another landmark year for Calder’s buy-side team. We built on the momentum of 2023 and navigated a continually evolving economic landscape. Interest rates fell throughout the year, in contrast to their rise in 2023, and the rapid growth in AI reshaped many industries.

Despite these advances, cautious lenders—potentially overcautious—moved slowly, impacting deal timelines. However, there was an increase in M&A volume in the upper market, while activity remained steady in the middle and lower middle markets.

Calder as a firm closed 46 transactions, just a few shy of our record from last year. While much of the year was spent investing in systems, processes, and infrastructure as a springboard for the future, despite not setting a new closing record, the Calder team, particularly the buy-side team, feels very strongly that changes and investments made in 2024 combined with robust market sentiment, have set up the team for multiple, massive steps forward in 2025.

Below is a recap of the year’s highlights and insights as we set our sights on 2025 with even greater determination.

Motivation for Acquisition

This year, our buy-side team guided potential buyers through the demographics of 211 unique acquisition searches, carefully tailored to meet their specific criteria. These searches included detailed analyses such as target counts, geographic heatmaps, service or product breakdowns, and revenue thresholds. If you’re considering a business acquisition, let us help you evaluate your search parameters and uncover actionable insights!

In 2024, our clients pursued acquisitions for a wide range of motivations, including growth and diversification into new markets, achieving vertical integration, or transitioning from corporate careers to business ownership.

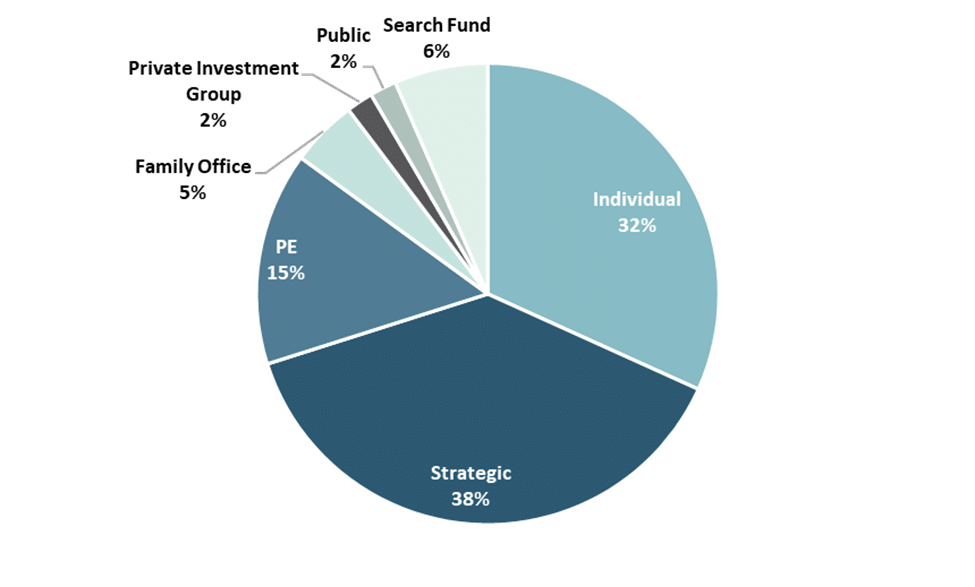

The buyers we served included individuals, search fund partners, family offices, private equity groups, and strategic acquirers—both independent and private equity-backed.

The Process

This year’s data reaffirmed the importance of resilience in the acquisition process. On average, buyers needed to submit 6 offers (including revised offers) to secure a signed LOI—a testament to the persistence required in today’s market.

The good news is that once a buyer reached the LOI stage with Calder’s buy-side team, more than 4 out of 5 (83.6%) deals successfully closed.

The average timeline from engagement to closing held steady at 8-11 months, encompassing 2-4 months for post-LOI due diligence and finalizing the transaction. With determination and a clear strategy, buyers can achieve their acquisition goals, and Calder’s team is here to support them every step of the way.

Lead Flow and Closed Deal Results

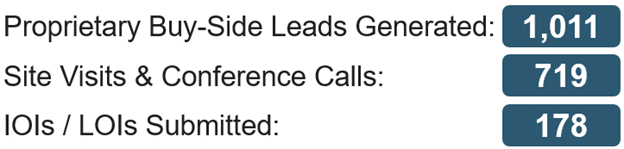

2024 saw an impressive volume of leads generated and introduced to our clients.

On average, Calder facilitated approximately 2.77 introductions and held 1.97 buyer-seller calls or meetings daily. Offers were submitted at a rate of one every two days, underscoring the diligence and pace of our team.

2025 Outlook

Looking ahead to 2025, we believe the immense demand of buyers relative to the low supply of quality sellers will continue to drive intense competition and bidding wars for listed deals. Every year, more private equity funds are raised, more individuals decide to leave the corporate world and more strategics struggle to grow organically and turn to inorganic growth through acquisition to attempt to hit growth goals. Unfortunately, buying a business isn’t getting any easier.

Recognizing these market dynamics, the buy-side team has continued to build and refine its proven network and outreach process that uncovers off-market sellers. This approach allows buyers to bypass competitive bidding wars and engage directly with business owners who are open to private sale discussions.

Many business owners are eager to sell but hesitate to engage an advisor or take their business to market for various reasons. Common concerns include maintaining confidentiality, avoiding the complexities and time commitment of a lengthy marketing process, and a reluctance to pay advisor fees. However, when our team reaches out, these owners are often open and enthusiastic about engaging in meaningful conversations.

Calder’s buy-side team has bolstered its ranks with key additions to start 2025, enhancing our ability to take on new searches and deliver exceptional results. With a record number of deals under LOI, surging interest in our services, and support from pro-business government initiatives, we are confident that 2025 will be a remarkable year of growth and success!

If you’d like to discuss your acquisition goals or reflect on 2024’s market trends, reach out to us today. Let’s make 2025 your breakthrough year!

Why work with Calder?

Calder works with clients on a guaranteed basis, so if we don’t deliver our clients don’t pay. Check out some of our current clients here. References are also available upon request.

Please contact Buy-Side Search Director Ben Sundquist at [email protected] or 734-417-4813 to learn more!