2023 was a turbulent year in the economy, with rising interest rates, bank failures, falling but high inflation, persistent labor challenges, and very low seller sentiment. This did not stop Calder’s buy-side team from soaring to new heights!

Below is a 2023 recap and while it’s good to review the past, we won’t dwell on it for too long as we march into 2024 at a blistering pace, determined to build on our success. We’ve added new team members to our buy-side team in 2024 in preparation for more clients and closings!

Motivation for Acquisition

In 2023, we researched and educated potential buyers on the demographics of 189 unique acquisition searches according to the specific criteria they provided to us. Our team is happy to look into any search criteria and educate a potential buyer on the characteristics of the search (i.e. number of targets, heatmap of their locations, breakdown by service/product type and size, etc.). Reach out to us if you’d like us to look into a search for you!

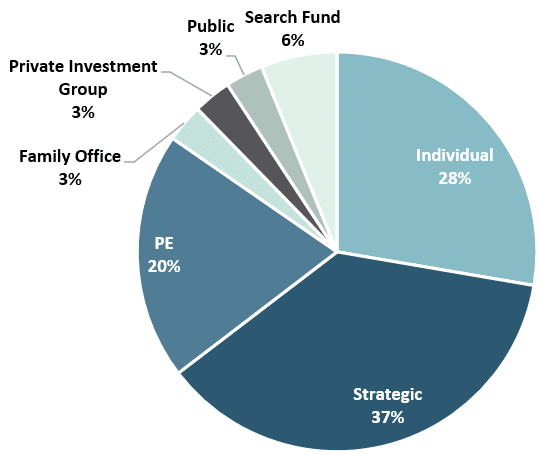

Our buy-side team closed platform and bolt-on transactions on behalf of all types of buyers including family offices, private equity, family-owned and private equity-backed strategic acquirers, individuals, and individuals partnered with search funds.

Motivations for acquisition varied from growth and diversification into new segments, to a desire to leave the corporate world and invest and manage one’s portfolio.

The Process

We worked with a variety of different buyers:

It was reinforced to us that buyers must be resilient! We learned that on average it takes 6 offers (including resubmissions of the same offer) to get to a signed LOI. That is a lot of work and at-bats!

The good news is that once a buyer we are working with goes under LOI, more than 4 out of 5 (81.37%) make it across the closing table.

Overall, the average timeline from engagement to closing is 7-10 months, inclusive of 2-3 months of post-LOI due diligence and closing.

Lead Flow and Closed Deal Results

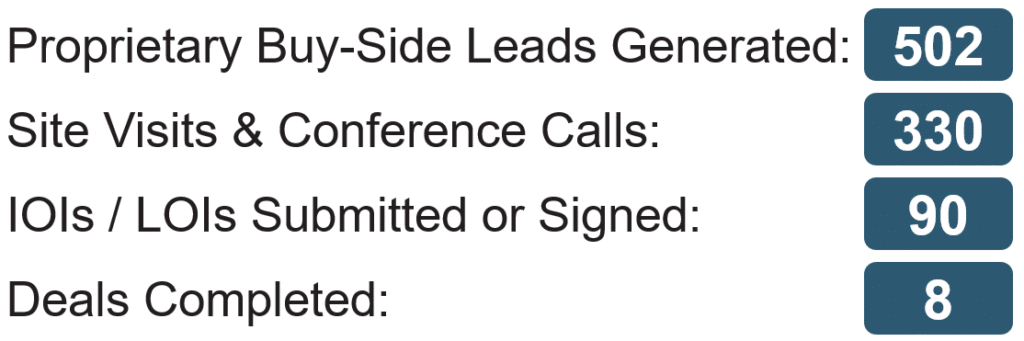

Holy smokes we found a lot of leads in 2023!

This translates to roughly two introductions made and 1.3 calls/meetings held each workday! And an offer submitted every three work days!

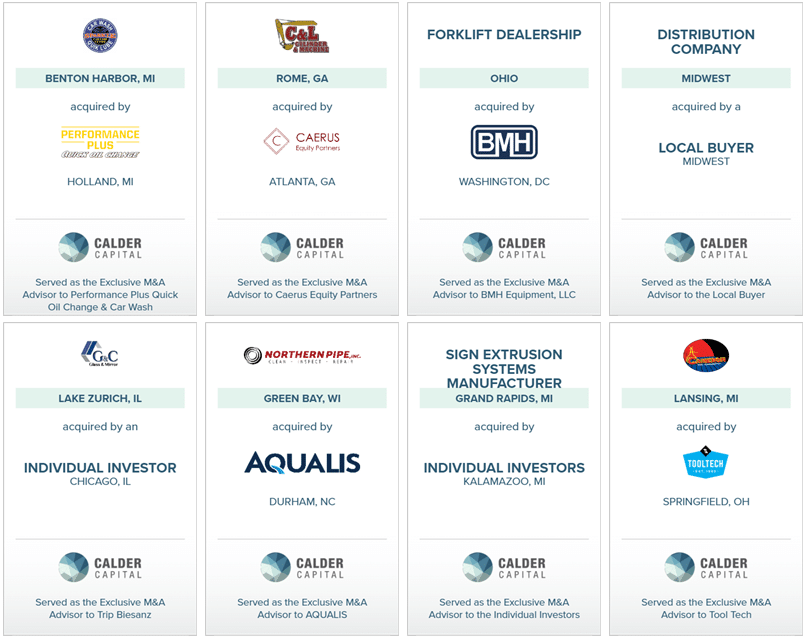

Our buy-side team successfully completed eight transactions. All except for one were proprietary off-market deals (not represented by a sell-side advisor or actively selling).

Tombstones

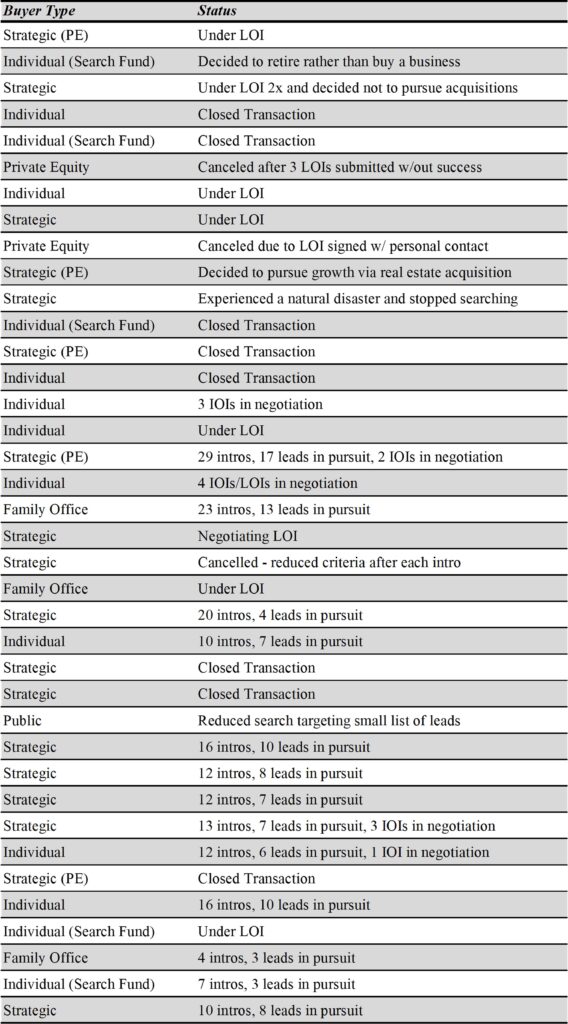

Active 2023 Client Status Update

Here is an overview of active 2023 clients, including closings, cancellations, and search processes currently underway!

Case Studies

The best way to search for business acquisitions is by pursuing off-market deal flow. If you are not convinced, read some of our buy-side case studies and see for yourself the incredible deals our clients are putting together!

Make sure to read our 2024 Buyer’s Outlook to make sure you are geared up for success!

If you’d like to discuss anything that occurred in 2023 or how to get started on the right track in 2024, please reach out.

Why work with Calder?

Calder works with clients on a guaranteed basis, so if we don’t deliver our clients don’t pay. Check out some of our current clients here.

Alternatively, if you enter your criteria here our system will automatically alert you to any current or future sell-side opportunities we are representing that are of interest to you. Be advised, these engaged sellers are represented by us and selling through a competitive bid process.

Contact Sam Scharich at [email protected] or 616-970-6124 and reserve your spot before our team fills up!

Learn more

Calder Capital/SBDA Close Record-Breaking 48 Deals in 2023!

With the successful closings of two businesses on 12/28/23, the Calder Capital/SBDA team completed transaction #48 for 2023, surpassing previous annual transaction and revenue records. This is despite global M&A deal volume declining by 7% and 27% year-over-year dollar volume decline rounding off the lowest three-quarter total since 2013…

The 2024 Buyer’s Outlook: Navigating a More Challenging M&A Market

In the dynamic world of mergers and acquisitions (M&A), 2024 presents a unique set of challenges and opportunities for buyers. With the landscape evolving rapidly, this blog post delves into what makes buying businesses in 2024 more complex and competitive, especially…