Calder Capital is pleased to announce that Diamond Die & Mold Company of Clinton Township, Michigan has been acquired by individual investors of Cicero, New York.

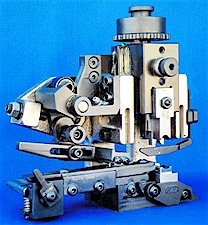

Diamond Die is a manufacturer of tooling and equipment for the wire harness industry founded in 1956. Looking to transition into retirement following 40+ years of service as co-owner and President, JoAnn Hinds, engaged Calder Capital to help transition her business.

To celebrate retirement, JoAnn plans to travel to Iceland and the Northern Islands of Scotland. She also looks forward to more time to spend with her grandchildren. JoAnn shared with our team that if she ever finds herself bored, you will likely find her back at Diamond Die where she will continue to lend a helping hand whenever possible.

JoAnn’s unwavering determination led her to search for a buyer who not only aligned naturally with her father’s legacy but also possessed the capability to carry it forward.

Brian and Cindy Babin proved to be the perfect choice for this role, bringing a combination of expertise and experience to the table. Brian’s background in the wire harness, tooling, and machining industry has provided him with valuable management skills, while Cindy’s previous administrative management roles in the medical sector have equipped her with a strong foundation in organizational efficiency. Brian shared that they are happy to have the opportunity to manage and grow a business for themselves rather than a large corporate entity.

JoAnn demonstrated such unwavering confidence in the Babins that she invited them to join her at an industry trade show before the deal was finalized. This gesture speaks volumes about her trust and admiration for their capabilities.

Garrett Monroe of Calder Capital served as the lead Mergers & Acquisitions Advisor.

Prior to partnering with Calder Capital, JoAnn had previously collaborated with two other M&A Advisors resulting in only a few unpalatable offers. Calder Capital created a competitive market and got Diamond Die in front of serious buyers. Diamond Die engaged with Calder Capital only 7 months before closing, during which time, 131 CIMs and 8 serious offers were presented.

“Working with Garrett and Calder Capital was a 10/10 experience,” JoAnn commented. “Compared to the other brokers I interacted with, he was an 11/10! He was great every step of the way and very diligent in his efforts.”

“This was a rewarding transaction for me – even though I put 110% effort into all my engagements. I turn up the competitive heat when I am working with an owner that was disappointed by past engagements, brokers, or M&A advisors. JoAnn and Diamond Die deserved to find a buyer that was going to maintain the legacy that JoAnn’s father started, and JoAnn continued,” Garrett commented. “We achieved an all-cash offer for JoAnn with an efficient closing timeline. Brian and Cindy Babin are the perfect couple to preserve the family culture that JoAnn instilled in the company. Brian and Cindy were originally from Macomb County but traveled the country frequently for Brian’s past jobs/careers. It’s funny how these processes shake out. Brian and Cindy were able to move back to Macomb County from New York, and Brian also had previous experience in the tool & die and wire harness industries. I’d say that is an excellent fit!”

When asked about his experience with Calder, Brian Babin shared “[It was] very professional with a well-organized and structured process.”

“As the seller’s attorney for Diamond Die & Mold Co, I’m thrilled about this sale. It preserves the company’s 60-year legacy and secures continued employment for all employees in metro Detroit. The new owner shares a deep appreciation for the company’s history and its employees. With a strong foundation in place, exciting growth and expansion opportunities lie ahead,” shared Andy Goldberg, legal counsel for Diamond Die. “My experience working with Garrett Monroe and Calder Capital was excellent. His deep knowledge of the die and mold industry led to finding the perfect buyer. Garrett’s responsiveness and professionalism made the process seamless for the seller. I highly recommend Garrett and his team at Calder Capital to anyone considering selling their business.”

Calder Capital, LLC served as the exclusive Mergers & Acquisitions Advisor to Diamond Die & Mold.

The Law Office Of Andrew J Goldberg served as legal counsel to Diamond Die & Mold.

The terms of the transaction were not disclosed.

About Diamond Die & Mold Co.

Diamond Die & Mold Co. is a leading manufacturer specializing in tooling and equipment for the wire harness industry. Established in 1956 by Joseph Baldyga and Horst Jensen, the company initially focused on tool and die services with injection molding capabilities. Following Horst’s passing in 1982, Joseph assumed full ownership, and his daughter JoAnn Hinds joined the company two months later. With JoAnn’s pivotal role, Diamond Die & Tool Co. has grown its workforce to 16 employees. JoAnn’s leadership has been instrumental in diversifying the company beyond automotive into the appliance industry while upholding its reputation as a quality-centric manufacturer.

About Calder Capital

Calder Capital is a lower middle market investment bank providing mergers and acquisitions advisory services to business owners, entrepreneurs, family offices, and investors across the United States. Our dedicated team of professionals combines extensive industry experience, technological innovation, negotiation savvy, and key relationships to exhibit exceptional execution. Calder’s services include mergers and acquisitions advisory, private funds and capital markets advisory, and business valuations.