Calder Capital, a nationwide M&A firm, is thrilled to announce the successful acquisition of Atlas Restaurant Supply, a distributor to the food services industry, by Kamran & Company and Culinex, backed by Leedon Park Capital.

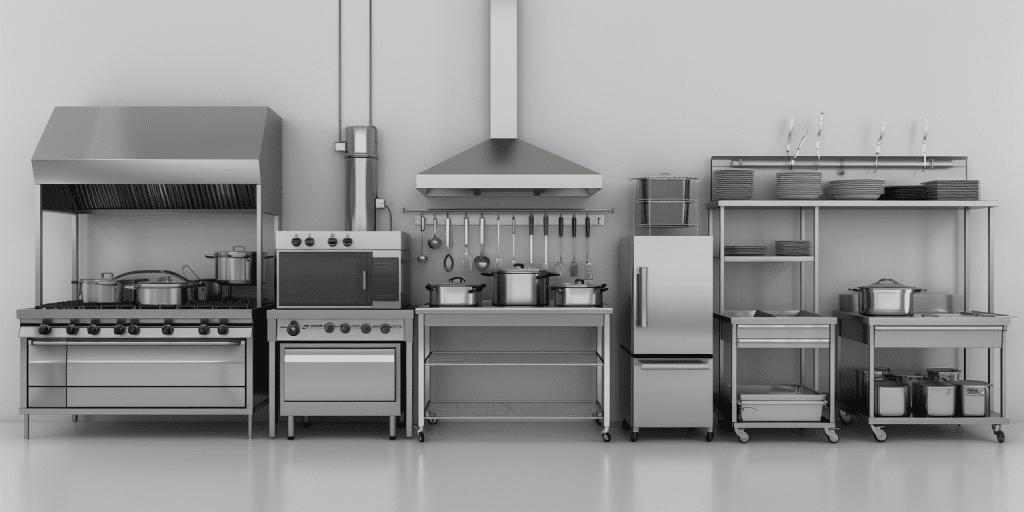

Atlas Restaurant Supply is a supplies and equipment distributor for businesses in the food services industry. Founded in 1965 by Tom Vavul, Atlas offers an extensive inventory of products, from heavy-duty cooking equipment to paper and plastic disposables, as well as dining room furniture and janitorial supplies. Looking to exit the business, Atlas engaged Calder Capital’s Sell-Side team.

Leedon Park Capital, a private equity firm based in North Carolina, focuses on establishing lasting, long-term partnerships with companies in the middle market. Culinex is a premier designer and supplier to the food service industry from North Dakota, while Kamran & Company. is a diversified food service system design and installation company based in California. Together, they aim to expand their national footprint and drive growth in the food service sector.

Kregg Kiel and Andrew Williams of Calder Capital served as the lead Mergers and Acquisitions Advisors for Atlas Restaurant Supply.

Calder’s on-market process garnered significant interest, resulting in 155 interested parties and 125 CIMs sent to qualified buyers, seven indications of interest (IOIs) received, and three competitive letters of intent (LOIs) contemplated.

“Congratulations to all parties on a successful transaction,” stated Calder Founder Max Friar, “Advisors Kregg Kiel and Andrew Williams demonstrated their deal savvy in managing a successful transaction that involved a significant number of stakeholders. Calder remains dedicated to the distribution sector within the M&A space, and this deal marks another significant achievement for our team. We are very happy for the Atlas team, and the new ownership, and wish them the best of success going forward!”

Calder Capital, LLC served as the exclusive Mergers and Acquisitions Advisor to Atlas Restaurant Supply. Andrew Helfrich of Barnes & Thornburg served as legal counsel to Atlas Restaurant Supply. Bruce Hallett of Hallett & Perrin and various individuals from CohnReznick served as legal counsel and CPA, respectively, for the buyers.

The terms of the transaction were not disclosed.

About Atlas Restaurant Supply

Atlas Restaurant Supply, established in 1965 by Tom Vavul, has been a cornerstone in the food services industry, providing everything a restaurant needs except for the food. The company offers an extensive inventory ranging from heavy-duty cooking equipment to paper and plastic disposables, as well as dining room furniture and janitorial supplies. With multiple locations around Indiana and Michigan and 40+ employees, Atlas serves a diversified customer base that includes restaurants, educational facilities, hotels, and healthcare facilities.

About Leedon Park Capital

Leedon Park Capital is a private equity firm based in Charlotte, North Carolina, dedicated to establishing long-term partnerships with middle-market companies and management teams. The Company focuses on helping companies with strong cultures and teams through their next phase of growth by providing complementary skills and support.

About Kamran & Co.

Kamran & Co. is a diversified provider in the food service industry with decades of experience in design, construction, equipment sales, and maintenance. They differentiate themselves by offering vertically integrated solutions, from custom-designed spaces to affordable, high-quality appliances and expert maintenance services.

About Culinex

Culinex is a premier food product development consultancy renowned for delivering innovative and delicious food solutions. The Company offers comprehensive services, including food service equipment and supplies, design consulting, and delivery and installation, positioning itself at the forefront of food technology.

About Calder Capital

Founded in 2013, Calder Capital is a lower middle market investment bank providing mergers and acquisitions advisory services to business owners, entrepreneurs, family offices, and investors across the United States. Our dedicated team of professionals combines extensive industry experience, technological innovation, negotiation savvy, and key relationships to exhibit exceptional execution. Calder’s services include mergers and acquisitions advisory, private funds and capital markets advisory, and business valuations.