Time is of the essence and we are seeking any and all offers!

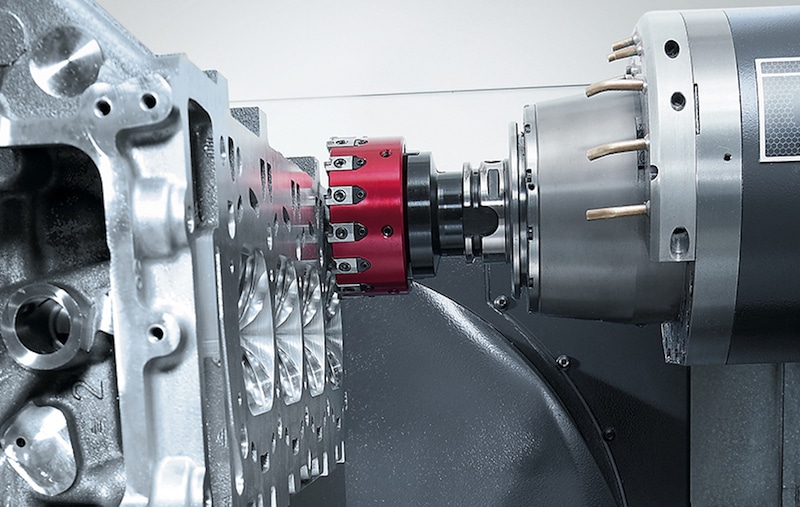

Established nearly 40 years ago, this Michigan-based CNC Company’s impressive investment in quality machinery, tooling, and equipment has made it not only more versatile, but more productive and less costly to run. The company maintains numerous “Big Iron” boring mills capable of flawlessly machining unusually large parts for aircraft, oil & gas and automotive applications.

The present owner suffered a stroke several years ago. This was compounded by the Company’s concentration of oil & gas customers, which went away when the oil markets crashed. While the Company’s sales have partially stabilized to approximately $100-110K per month, that level is shy of their break-even. The owner no longer wishes to continue injecting his own capital into the business and the Company’s bank, while generally cooperative, has begun to make overtures regarding the outstanding loan of approximately $1,100,000.

The Company is well-positioned to be vertically integrated with a strategic buyer seeking to utilize its unique base of equipment, industry contacts and skilled management team. The Company is presently operating at approximately 20% capacity. Aerospace customers make up 80% of sales with automotive making up the balance.

The owner is willing to participate in a reasonable transition period.

The Company’s offices and plant are comprised of a 30,000 square foot facility on 4.9 acres of land. The manufacturing area is 28,000 square feet and the administration offices are 2,800 square feet. All 28,000 square feet of manufacturing is under crane. The owner would prefer to sell the real estate in a combined transaction.

- The company maintains numerous “Big Iron” boring mills capable of flawlessly machining unusually large parts for aircraft, oil & gas and automotive applications.

Financial Summary

CY 2016 Revenue: $1,246,817

Estimated Real Estate Value: $1,500,000 (July 2016)

Fair Market Value In Place of Machinery & Equipment: $2,309,850 (June 2016)

Seeking any and all offers for business and real estate assets!

- As of June 2016, Fair Market Value In Place of Machinery & Equipment was $2,300,000+

Investment Highlights

Management Team – As the owner has become less active in the day-to-day oversight of the company, his son and a seasoned team of six other department heads have assumed oversight and management of the Company and are optimistic about leading it into the future.

Intellectual Property Library – The Company holds use patents for numerous machines they have developed and sold. These machines have intellectual value and can be used domestically, as well as in developing countries where a lower volume of product is required. These include a tapping machine, a ring-transfer machine and specialized equipment used by the oil and hydraulic industries.

Location – The Company is geographically well placed to serve major Michigan manufacturing hubs.

- As the owner has become less active in the day-to-day oversight of the company, his son and a seasoned team of six other department heads, have assumed oversight and management of the Company and are optimistic about leading it into the future.

Growth Opportunities

Physical Expansion – The property would allow for further physical expansion if desired.

Sales/Marketing – While the Company does regularly seek out new work, there is not a dedicated full-time salesperson. Additionally, while the company maintains a website, they are not actively updating or marketing their services on the Internet.

Under Capacity – Previously the Company had produced revenues of $6MM+ at the current facility. Due to a number of unforeseen circumstances (particularly the decline of the oil & gas industry), revenues have declined in recent years. However the owner has continued to make significant investments that have effectively prepared the company for the next 40 years.

The BEST way to receive confidential information about this opportunity is to fill out the form below.

Upon doing so you will receive a link via email to review and sign our confidentiality agreement. Once signed, we will be able to further the conversation and send you the confidential Offering Documents. Please contact Rick Purcey at [email protected] or 269-430-3377 with any questions. Interested parties must demonstrate proof of financial capability, sign a Non-Disclosure Agreement and have a brief introductory phone call with a broker. Inquire today about this established boring mill machining company for sale!